This week, I’m rerunning some popular posts while I prepare for Friday’s live video webinar: PBM Industry Update: Trends, Challenges, and What’s Ahead.

Click here to see the original post from January 2025.

For 2025, the three largest pharmacy benefit managers (PBMs)—Caremark (CVS Health), Express Scripts (Cigna), and Optum Rx (United Health Group)—have again each excluded hundreds of drugs from their standard formularies. You can find our updated counting below.

As you’ll see below, the combination of formulary exclusion and private labels is creating an increasingly confusing and crowded biosimilar marketplace.

For 2025, the Big Three PBMs shifted national formularies to favor their private-label biosimilars over Humira and its many biosimilar competitors. In fact, nearly all marketed Humira biosimilars are excluded from the larger PBMs’ 2025 formularies. Meanwhile, Stelara—this year’s big pharmacy benefit biosimilar launch—remains on the PBMs’ formularies, but will share space with PBMs’ private label products.

Like it or not, PBMs’ financial benefits from their private-label product align with the benefits to plan sponsors and patients. But the PBMs’ strategies, combined with the warped incentives baked into the Inflation Reduction Act, raise questions about the viability of the biosimilar marketplace.

What do you think? I encourage you to share your thoughts with the Drug Channels community on LinkedIn.

Drug Channels delivers timely analysis and provocative opinions from Adam J. Fein, Ph.D., the country's foremost expert on pharmaceutical economics and the drug distribution system. Drug Channels reaches an engaged, loyal and growing audience of more than 100,000 subscribers and followers. Learn more...

Tuesday, April 01, 2025

Monday, March 31, 2025

The Top Pharmacy Benefit Managers of 2024: Market Share and Key Industry Developments

Three’s still company in the world of pharmacy benefit managers.

For 2024, nearly 80% of all equivalent prescription claims were processed by three familiar companies: the CVS Caremark business of CVS Health, the Express Scripts business of Cigna, and the Optum Rx business of UnitedHealth Group. The names haven’t changed, but shifting relationships and contract shakeups have altered the plot, with Express Scripts stepping into a new lead role.

Below, we break down the latest market share data from Drug Channels Institute (DCI), explore the developments driving these changes, and examine what they signal for the future of the PBM landscape.

For a deeper dive into the state of the industry, join me this Friday, April 4, 2025, for our live video webinar: PBM Industry Update: Trends, Challenges, and What’s Ahead.

P.S. Special launch pricing on our new 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers ends today (3/31/25)!

For 2024, nearly 80% of all equivalent prescription claims were processed by three familiar companies: the CVS Caremark business of CVS Health, the Express Scripts business of Cigna, and the Optum Rx business of UnitedHealth Group. The names haven’t changed, but shifting relationships and contract shakeups have altered the plot, with Express Scripts stepping into a new lead role.

Below, we break down the latest market share data from Drug Channels Institute (DCI), explore the developments driving these changes, and examine what they signal for the future of the PBM landscape.

For a deeper dive into the state of the industry, join me this Friday, April 4, 2025, for our live video webinar: PBM Industry Update: Trends, Challenges, and What’s Ahead.

P.S. Special launch pricing on our new 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers ends today (3/31/25)!

Friday, March 28, 2025

The New Playbook for Patient Support Programs: Flexibility, Focus, and Forward-Thinking

Today’s guest post comes from Josh Marsh, Vice President and General Manager, Sonexus™ Access and Patient Support at Cardinal Health.

Josh discusses how patient support programs are evolving, including the shift toward outsourcing individualized hub functions. He lists five characteristics pharmaceutical companies should look for when evaluating outsourced support for long-term program success.

To learn more, download Cardinal Health’s latest industry survey on hub model management: A New Era for Patient Support Programs.

Read on for Josh’s insights.

Josh discusses how patient support programs are evolving, including the shift toward outsourcing individualized hub functions. He lists five characteristics pharmaceutical companies should look for when evaluating outsourced support for long-term program success.

To learn more, download Cardinal Health’s latest industry survey on hub model management: A New Era for Patient Support Programs.

Read on for Josh’s insights.

Labels:

Guest Post,

Sponsored Post

Wednesday, March 26, 2025

Drug Channels News Roundup, March 2025: PBM Unbundling Update, Stelara Biosimilar Price War, My $0.02 on the Optum Rx News, Follow the Dollar, and #DCLF2025

Spring has officially arrived in sunny downtown Philadelphia—the proud home base of Drug Channels. As you can see on the right, we celebrated in Miami at the Drug Channels Leadership Forum.

The vernal equinox also brought a surprising surge of industry updates and noteworthy news you won’t want to miss:

P.S. Join my more than 61,000 LinkedIn followers for daily links to neat stuff along with thoughtful and provocative commentary from the DCI community.

The vernal equinox also brought a surprising surge of industry updates and noteworthy news you won’t want to miss:

- Blue Shield of California provides a puzzling update to its PBM unbundling effort

- The Stelara biosimilar price war begins

- My reaction to Optum Rx’s pharmacy reimbursement announcement

- A valuable Follow the Dollar primer

P.S. Join my more than 61,000 LinkedIn followers for daily links to neat stuff along with thoughtful and provocative commentary from the DCI community.

Coming soon: PBM Industry Update: Trends, Challenges, and What’s Ahead. Our first webinar of the year will tackle the most controversial drug channel participants. Join Adam J. Fein, Ph.D., on April 4, 2025, from 12:00 p.m. to 1:30 p.m. ET, as he shares his expert analysis on critical industry developments. Click here to learn more and sign up.

Tuesday, March 25, 2025

Reflections and Photos from the Inaugural Drug Channels Leadership Forum 2025

Wow! What an absolutely incredible time at the inaugural Drug Channels Leadership Forum (DCLF)!

Paula and I are beyond grateful to everyone who took the stage to share their insights and to all who participated in making this event so impactful. (Even Paula got on the main stage!) The event was packed with thought-provoking discussions, candid insights, and dynamic exchanges. The HMP Global team delivered a truly first-class experience for the nearly 350 lucky attendees.

Here are some brief video highlights. Click here if you can't see the video below.

We also had a professional photographer. Here's what happened in the morning of the first day.

You can see more fun photos from the event here on my LinkedIn account:

You can find attendees’ photos by searching “#DCLF2025” on LinkedIn. (Be sure to use quotation marks and then sort by “Latest.”)

BTW, you won’t see any news stories about the DCLF. That’s because the media were not invited and the sessions were not recorded. You had to be in the room where it happened.😉

The DCLF will return in March 2026.

P.S. A special shoutout to the phenomenal HMP Global team. Your hard work and dedication made this event unforgettable!

Paula and I are beyond grateful to everyone who took the stage to share their insights and to all who participated in making this event so impactful. (Even Paula got on the main stage!) The event was packed with thought-provoking discussions, candid insights, and dynamic exchanges. The HMP Global team delivered a truly first-class experience for the nearly 350 lucky attendees.

Here are some brief video highlights. Click here if you can't see the video below.

We also had a professional photographer. Here's what happened in the morning of the first day.

[Click to Enlarge]

You can see more fun photos from the event here on my LinkedIn account:

You can find attendees’ photos by searching “#DCLF2025” on LinkedIn. (Be sure to use quotation marks and then sort by “Latest.”)

BTW, you won’t see any news stories about the DCLF. That’s because the media were not invited and the sessions were not recorded. You had to be in the room where it happened.😉

The DCLF will return in March 2026.

P.S. A special shoutout to the phenomenal HMP Global team. Your hard work and dedication made this event unforgettable!

[Click to Enlarge]

Monday, March 24, 2025

Informa Connect’s Life Sciences Pricing & Contracting USA

Informa Connect’s Life Sciences Pricing & Contracting USA

May 19-21, 2025 | Philadelphia, PA

Drug Channels readers save 10% with code 25DRCH10*

Pricing & Contracting USA arrives at an important moment for our industry. As you work to navigate the evolving healthcare landscape, this annual event brings together 60+ expert speakers from 70+ companies to lead the critical discussions that will drive comprehensive market strategy, uniting Medicaid, Policy, Pricing, Contracting & Reporting thought leaders.

With 52 sessions across 6 workshops and 5 tracks, this event features:

Join us where Medicaid, Commercial & Government Teams will collaborate to drive a successful market strategy!

View the agenda for Pricing & Contracting USA to see the complete picture – the program, speakers, and more, and visit www.informaconnect.com/pricing-contracting-usa for further details and to register. Drug Channels readers will save 10% off when they use code 25DRCH10 and register prior to April 30, 2025.*

*Cannot be combined with other offers or used towards a current registration. Cannot be combined with special category rates or other offers. Other restrictions may apply.

The content of Sponsored Posts does not necessarily reflect the views of HMP Omnimedia, LLC, Drug Channels Institute, its parent company, or any of its employees. To find out how you can publish an event post on Drug Channels, please contact Paula Fein (paula@DrugChannels.net).

May 19-21, 2025 | Philadelphia, PA

Drug Channels readers save 10% with code 25DRCH10*

Pricing & Contracting USA arrives at an important moment for our industry. As you work to navigate the evolving healthcare landscape, this annual event brings together 60+ expert speakers from 70+ companies to lead the critical discussions that will drive comprehensive market strategy, uniting Medicaid, Policy, Pricing, Contracting & Reporting thought leaders.

With 52 sessions across 6 workshops and 5 tracks, this event features:

- Wholesaler/Manufacturer Team-to-Team Meet-and-Greets: Direct industry collaboration

- Executive Programming: Fireside Chat with External Counsel, Closed Door Executive Strategy Summit and Luncheon

- Interactive Sessions: Speed Networking, AI Lunch and Learn

- Strategic Working Groups: Medicaid Working Group Report, 80 Minute Industry Strategy Working Group

- The Hottest Topics: Covering Government pricing, contracting and reporting fundamentals, MDRP, the Medicaid Final Rule, State Drug Price Transparency, PDAB, Medicaid, VA and IRA penalties, PBM evolution and regulation, 340B challenges, GTN, PhRMA, GPO Management, specialty distribution and cold chain, AI and automation and more.

Join us where Medicaid, Commercial & Government Teams will collaborate to drive a successful market strategy!

View the agenda for Pricing & Contracting USA to see the complete picture – the program, speakers, and more, and visit www.informaconnect.com/pricing-contracting-usa for further details and to register. Drug Channels readers will save 10% off when they use code 25DRCH10 and register prior to April 30, 2025.*

*Cannot be combined with other offers or used towards a current registration. Cannot be combined with special category rates or other offers. Other restrictions may apply.

The content of Sponsored Posts does not necessarily reflect the views of HMP Omnimedia, LLC, Drug Channels Institute, its parent company, or any of its employees. To find out how you can publish an event post on Drug Channels, please contact Paula Fein (paula@DrugChannels.net).

Friday, March 21, 2025

The End of the Blockbuster Era: Unlocking Growth with Direct-to-Patient Commercialization

Today’s guest post comes from Greg Skalicky, President of EVERSANA.

Greg discusses some of the challenges manufacturers face with product commercialization, patient access and adherence, and negotiating partnerships with pharmacy benefit managers (PBMs). He introduces us to EVERSANA DIRECT Commercialization™, a direct-to-patient change/model.

To learn more about EVERSANA DIRECT Commercialization™ and how the direct-to-patient model can help you, meet with EVERSANA at the Asembia Summit in Las Vegas.

Read on for Greg's insights.

Greg discusses some of the challenges manufacturers face with product commercialization, patient access and adherence, and negotiating partnerships with pharmacy benefit managers (PBMs). He introduces us to EVERSANA DIRECT Commercialization™, a direct-to-patient change/model.

To learn more about EVERSANA DIRECT Commercialization™ and how the direct-to-patient model can help you, meet with EVERSANA at the Asembia Summit in Las Vegas.

Read on for Greg's insights.

Labels:

Guest Post,

Sponsored Post

Tuesday, March 18, 2025

NOW AVAILABLE: The 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers

I am pleased to announce that Drug Channels Institute’s new 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers is now available for purchase and immediate download.

Now in its 16th edition, this report remains the most comprehensive, fact-based resource for understanding the entire U.S. drug pricing, reimbursement, and dispensing system. It serves as the ultimate guide to the complex web of interactions within U.S. prescription drug channels.

What's inside?

You can pay online using Visa, MasterCard, American Express, Discover, and PayPal. If you prefer to pay by corporate check or ACH, click here to request an invoice.

Want to bundle the report with DCI’s video webinars? Email Paula Fein (paula@drugchannels.net).

If you preordered, you should have received an email with download instructions last week. Didn’t get it? Contact us at dcisupport@hmpglobal.com, and we’ll take care of it.

WHAT’S GOING ON

Twice a year, the DCI team researches and writes two comprehensive, fact-based, and nonpartisan reports on drug channel economics. In some small way, we aim to make the world a slightly smarter place.

Our reports are widely used by nearly every company involved in the drug channel:

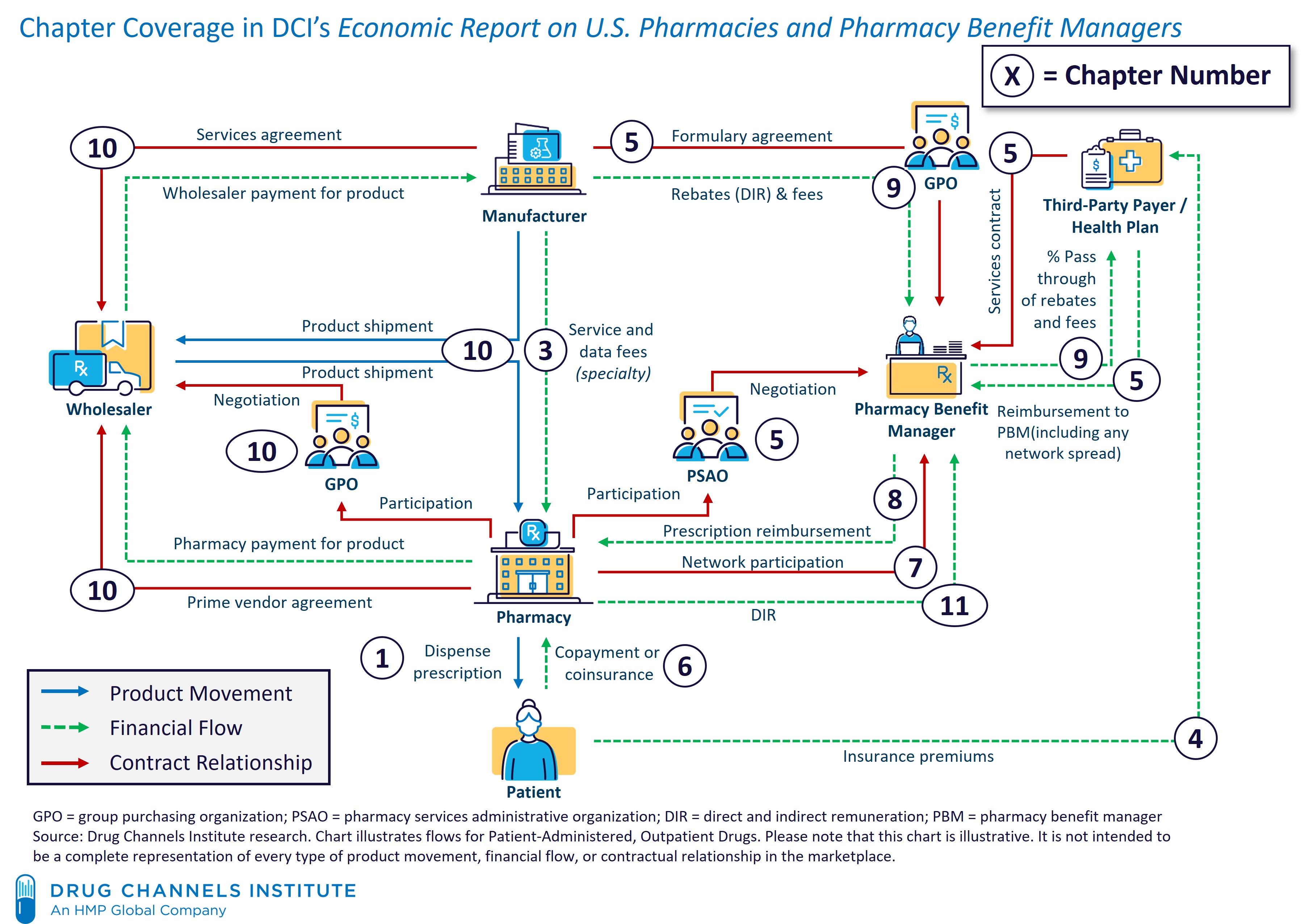

The chart below illustrates the depth and breadth of the 2025 edition, with chapter numbers corresponding to each channel flow.

FUN FACTS ABOUT THE 2025 EDITION

Enjoy!

- Download a free 30-page report overview—including key industry trends, What's New in this edition, the Table of Contents, and a List of Exhibits

- Read the press release: HMP Global’s Drug Channels Institute Releases 2025 Economic Report on U.S. Pharmacies and PBMs, Examining $683 Billion Market

Order before March 31, 2025 to receive special discounted pricing!

Now in its 16th edition, this report remains the most comprehensive, fact-based resource for understanding the entire U.S. drug pricing, reimbursement, and dispensing system. It serves as the ultimate guide to the complex web of interactions within U.S. prescription drug channels.

What's inside?

- 12 chapters, 540+ pages, and 268 exhibits

- Nearly 1,200 endnotes with hyperlinks to source materials

- Substantial new material—outlined on page ix of the report overview

You can pay online using Visa, MasterCard, American Express, Discover, and PayPal. If you prefer to pay by corporate check or ACH, click here to request an invoice.

Want to bundle the report with DCI’s video webinars? Email Paula Fein (paula@drugchannels.net).

If you preordered, you should have received an email with download instructions last week. Didn’t get it? Contact us at dcisupport@hmpglobal.com, and we’ll take care of it.

WHAT’S GOING ON

Twice a year, the DCI team researches and writes two comprehensive, fact-based, and nonpartisan reports on drug channel economics. In some small way, we aim to make the world a slightly smarter place.

Our reports are widely used by nearly every company involved in the drug channel:

- Pharmaceutical manufacturers

- Wholesalers, pharmacists, pharmacy owners

- Hospitals, benefit managers, and managed care executives

- Policy analysts, investors, consultants, and more

The chart below illustrates the depth and breadth of the 2025 edition, with chapter numbers corresponding to each channel flow.

FUN FACTS ABOUT THE 2025 EDITION

- The 12 chapters are self-contained—you don't need to read them in order. (Really!)

- There are tons of internal hyperlinks to help you navigate and focus on what matters most to you.

- We’ve updated all market and industry data with the most current insights, including our annual analyses of the largest pharmacies, specialty pharmacies, and PBMs.

- Many sections have been expanded and reorganized to better reflect the latest industry developments. Check out the What’s New section in the report overview for details.

- You have the option to download an additional PowerPoint file with images of all 268 exhibits—making it easier to share insights with your team. (Note: All license versions include exhibits within the text.)

- There are a staggering 1,163 endnotes (!), most of which have direct hyperlinks to original source materials, giving you a deeper knowledge base beyond what’s in the report.

- Sadly, I had to remove all corny jokes and pop culture references. So, no memes and absolutely no references to SpongeBob SquarePants.

Enjoy!

Labels:

Industry Trends,

PBMs,

Pharmacy

Friday, March 14, 2025

Direct-to-Consumer Models: Why They’re Expanding and Where They Deliver the Most Impact

Today’s guest post comes from Jordan Armstrong, Vice President of Business Development at AssistRx.

Jordan discusses the uptick in direct-to-consumer (DTC) models for life sciences organizations looking to navigate market challenges and improve patient access. He goes on to describe some potential risks and complexities associated with these models.

To learn about AssistRx’s technology solutions designed to simplify the patient experience and reduce channel costs, meet with AssistRx at the Drug Channels Leadership Forum, Informa Connect’s Access USA, and/or the Asembia Summit.

Read on for Jordan’s insights.

Jordan discusses the uptick in direct-to-consumer (DTC) models for life sciences organizations looking to navigate market challenges and improve patient access. He goes on to describe some potential risks and complexities associated with these models.

To learn about AssistRx’s technology solutions designed to simplify the patient experience and reduce channel costs, meet with AssistRx at the Drug Channels Leadership Forum, Informa Connect’s Access USA, and/or the Asembia Summit.

Read on for Jordan’s insights.

Labels:

Guest Post,

Sponsored Post

Tuesday, March 11, 2025

The Top 15 U.S. Pharmacies of 2024: Market Shares and Revenues at the Biggest Chains, PBMs, and Specialty Pharmacies

Next week, Drug Channels Institute (DCI) will release our 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers. It’s the 16th edition of our popular and comprehensive examination of the entire U.S. drug pricing, reimbursement, and dispensing system.

For 2024, DCI estimates that total prescription dispensing revenues at retail, mail, long-term care, and specialty pharmacies reached $683 billion, up 9% from the 2023 figure. GLP-1 agonist drugs remained the most significant driver of prescription revenue at retail pharmacies, accounting for more than 80% of dispensing revenue growth for 2024.

The table below—one of 268 in our new report—cues up DCI's first look at the 15 largest organizations that battled for those revenues. For a sneak peek at the complete report, click here to download our free 30-page report overview (including key industry trends, What's New in this edition, the Table of Contents, and a List of Exhibits). We’re offering special discounted pricing if you order before March 31, 2025.

For 2024, DCI estimates that total prescription dispensing revenues at retail, mail, long-term care, and specialty pharmacies reached $683 billion, up 9% from the 2023 figure. GLP-1 agonist drugs remained the most significant driver of prescription revenue at retail pharmacies, accounting for more than 80% of dispensing revenue growth for 2024.

The table below—one of 268 in our new report—cues up DCI's first look at the 15 largest organizations that battled for those revenues. For a sneak peek at the complete report, click here to download our free 30-page report overview (including key industry trends, What's New in this edition, the Table of Contents, and a List of Exhibits). We’re offering special discounted pricing if you order before March 31, 2025.

Will PBMs be able to maintain their position as the leading pharmacies? Find out at my upcoming live video webinar, PBM Industry Update: Trends, Challenges, and What's Ahead, on April 4, 2025, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

Labels:

Channel Management,

Industry Trends,

PBMs,

Pharmacy,

Specialty Drugs

Friday, March 07, 2025

Bridging the Gap in Patient Support: How GoodRx is Revolutionizing Access to Specialty Meds

Today’s guest post is from Divya Iyer, SVP Go-to-Market (GTM) Strategy at GoodRx.

Divya argues that patient support programs (PSPs) struggle with awareness and accessibility, preventing patients from fully benefiting from the financial and educational resources available to them. Divya discusses how integrating digital solutions from GoodRx can enhance engagement, streamline access to therapy, and improve patient outcomes.

To learn more, download the GoodRx Yellow Paper: GoodRx Helps Enable Pharma’s GTM Strategies.

Read on for Divya’s insights.

Divya argues that patient support programs (PSPs) struggle with awareness and accessibility, preventing patients from fully benefiting from the financial and educational resources available to them. Divya discusses how integrating digital solutions from GoodRx can enhance engagement, streamline access to therapy, and improve patient outcomes.

To learn more, download the GoodRx Yellow Paper: GoodRx Helps Enable Pharma’s GTM Strategies.

Read on for Divya’s insights.

Labels:

Guest Post,

Sponsored Post

Wednesday, March 05, 2025

Transparency vs. Reality: Troubling Lessons from PBM Disclosure Laws

Last week, President Trump signed yet another executive order, this time promising to make healthcare pricing more transparent.

While this marks another federal push for disclosure, states have already been quite active in this space. Since 2017, 24 states have passed 38 laws targeting healthcare transparency, with a strong focus on unraveling the complex economics of pharmacy benefit managers (PBMs).

But has all this legislation actually provided clarity—or just more red tape?

Below, I analyze four state reports on manufacturers’ rebate and fee payments to PBMs. The findings are dispiriting: mandated disclosures have yielded little actionable, reliable data. Lawmakers got to pat themselves on the back for “transparency,” but the data tell a different story. Federal efforts haven’t been much better.

Should we continue down the path of government-mandated reporting, or should plan sponsors be left to negotiate their own deals? I’ll explore these questions and more during DCI’s upcoming live video webinar, PBM Industry Update: Trends, Challenges, and What's Ahead on April 4, 2025. Click here to learn more and sign up.

While this marks another federal push for disclosure, states have already been quite active in this space. Since 2017, 24 states have passed 38 laws targeting healthcare transparency, with a strong focus on unraveling the complex economics of pharmacy benefit managers (PBMs).

But has all this legislation actually provided clarity—or just more red tape?

Below, I analyze four state reports on manufacturers’ rebate and fee payments to PBMs. The findings are dispiriting: mandated disclosures have yielded little actionable, reliable data. Lawmakers got to pat themselves on the back for “transparency,” but the data tell a different story. Federal efforts haven’t been much better.

Should we continue down the path of government-mandated reporting, or should plan sponsors be left to negotiate their own deals? I’ll explore these questions and more during DCI’s upcoming live video webinar, PBM Industry Update: Trends, Challenges, and What's Ahead on April 4, 2025. Click here to learn more and sign up.

Labels:

Gross-to-Net Bubble,

Health Care Policy,

PBMs