Friday, April 11, 2025

The Hidden Costs of Data Silos: How Pharma Manufacturers Can Stop Revenue Leaks and Strengthen Security

Jim and Sudhakar discuss some of the complex challenges manufacturers face as they deal with outdated data systems, information silos, misapplied discounts, and growing cyber security threats. They argue that these challenges will lead to lost revenue, third-party security breaches, and diminished patient care.

To learn more, register for Kalderos’ April 23, 2025 webinar: The Hidden Costs of Data Silos: Why Data Security & Architecture are Critical.

Read on for Jim and Sudhakar’s insights.

Wednesday, April 09, 2025

Mapping the Vertical Integration of Insurers, PBMs, Specialty Pharmacies, and Providers: DCI’s 2025 Update and Competitive Outlook

Proponents of these vertical integration arrangements argue that they create opportunities to mine healthcare costs. However, these organizations remain highly controversial, due to the potential for anti-competitive behavior. We summarize some of the key issues below.

While some major companies have narrowed their focus or unwound previous integration efforts, ongoing consolidation and selective deconsolidation will continue to reshape the healthcare biome by trying to build something epic, block by block.

What do you think? Click here to share your thoughts with the Drug Channels LinkedIn community.

Friday, April 04, 2025

Inflation-Adjusted U.S. Brand-Name Drug Prices Fell for the Seventh Consecutive Year as a New Era of Drug Pricing Dawns (rerun)

Click here to see the original post from January 2025.

It's time for Drug Channels’ annual examination of U.S. brand-name drug pricing.

For 2024, average brand-name drugs’ list prices grew by only 2.3%. What’s more, after adjusting for overall inflation, brand-name drug net prices dropped for an unprecedented seventh consecutive year. Details and additional commentary below.

As I predicted two years ago, the combined impact of changes to Medicaid rebates, the Inflation Reduction Act (IRA), and novel formulary access strategies have led multiple manufacturers to pop the gross-to-net bubble for high-list/high-rebate products. Consider the 18 products with list-price cuts shown below. Other drugmakers have reduced the rate of price increases, thereby inflating the bubble more slowly.

Employers, health plans, and pharmacy benefit managers (PBMs) determine the extent to which patients with insurance share in this ongoing deflation. But signs of change to the conventional approaches are undeniable.

New channel models—including smaller PBMs, cost-plus pharmacies, patient-paid discount card prescriptions, and manufacturers’ direct-to-patient businesses—are creating novel paths for drugs that can be sold without gross-to-net bubble distortions.

The bubble won’t vanish overnight. But for the first time in years, I can foresee a time when SpongeBob SquarePants will move on from Drug Channels.

Thursday, April 03, 2025

Vertical Integration Redux: How Pharmaceutical Wholesalers Are Transforming the Buy-and-Bill Market (rerun)

Click here to see the original post from February 2025.

ICYMI, the largest three pharmaceutical wholesalers—Cardinal Health, Cencora, and McKesson—are using vertical integration to build significant market positions in businesses beyond drug distribution.

In the video clip below, I review the vertical integration status of the largest three pharmaceutical wholesalers, illustrated in the chart below.

I also:

- Explain how wholesalers have strengthened their position in buy-and-bill channels for provider-administered drugs through vertical integration with their downstream customers.

- Discuss how and why private equity roll-up activity has provided wholesalers with strategic opportunities to acquire ownership stakes in practice management companies.

- Outline the market access implications for provider-administered biosimilars in the buy-and-bill market.

For more on the forces of change affecting drug distribution and the buy-and-bill market, see Chapter 6 of DCI’s recent 2024-25 Economic Report on Pharmaceutical Wholesalers and Specialty Distributors.

Wednesday, April 02, 2025

Four Revelations from Minnesota’s First 340B Transparency Report (rerun)

Click here to see the original post from December 2024.

It’s time to pay attention to the money behind the 340B curtain.

Minnesota just released the industry‘s first ever mandated financial report on the 340B Drug Pricing Program. Below, I do a wicked deep dive into the data and highlight crucial implications about spending, profits, pharmacies, plans, patients, program integrity, and more.

There are important limitations to these data. But Minnesota’s report marks a valuable first step on the yellow brick road to the wonderful world of transparency. I suspect similar reports are gonna be popular.

Tuesday, April 01, 2025

The Big Three PBMs’ 2025 Formulary Exclusions: Humira, Stelara, Private Labels, and the Shaky Future for Pharmacy Biosimilars (rerun)

Click here to see the original post from January 2025.

For 2025, the three largest pharmacy benefit managers (PBMs)—Caremark (CVS Health), Express Scripts (Cigna), and Optum Rx (United Health Group)—have again each excluded hundreds of drugs from their standard formularies. You can find our updated counting below.

As you’ll see below, the combination of formulary exclusion and private labels is creating an increasingly confusing and crowded biosimilar marketplace.

For 2025, the Big Three PBMs shifted national formularies to favor their private-label biosimilars over Humira and its many biosimilar competitors. In fact, nearly all marketed Humira biosimilars are excluded from the larger PBMs’ 2025 formularies. Meanwhile, Stelara—this year’s big pharmacy benefit biosimilar launch—remains on the PBMs’ formularies, but will share space with PBMs’ private label products.

Like it or not, PBMs’ financial benefits from their private-label product align with the benefits to plan sponsors and patients. But the PBMs’ strategies, combined with the warped incentives baked into the Inflation Reduction Act, raise questions about the viability of the biosimilar marketplace.

What do you think? I encourage you to share your thoughts with the Drug Channels community on LinkedIn.

Monday, March 31, 2025

The Top Pharmacy Benefit Managers of 2024: Market Share and Key Industry Developments

For 2024, nearly 80% of all equivalent prescription claims were processed by three familiar companies: the CVS Caremark business of CVS Health, the Express Scripts business of Cigna, and the Optum Rx business of UnitedHealth Group. The names haven’t changed, but shifting relationships and contract shakeups have altered the plot, with Express Scripts stepping into a new lead role.

Below, we break down the latest market share data from Drug Channels Institute (DCI), explore the developments driving these changes, and examine what they signal for the future of the PBM landscape.

For a deeper dive into the state of the industry, join me this Friday, April 4, 2025, for our live video webinar: PBM Industry Update: Trends, Challenges, and What’s Ahead.

P.S. Special launch pricing on our new 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers ends today (3/31/25)!

Friday, March 28, 2025

The New Playbook for Patient Support Programs: Flexibility, Focus, and Forward-Thinking

Josh discusses how patient support programs are evolving, including the shift toward outsourcing individualized hub functions. He lists five characteristics pharmaceutical companies should look for when evaluating outsourced support for long-term program success.

To learn more, download Cardinal Health’s latest industry survey on hub model management: A New Era for Patient Support Programs.

Read on for Josh’s insights.

Wednesday, March 26, 2025

Drug Channels News Roundup, March 2025: PBM Unbundling Update, Stelara Biosimilar Price War, My $0.02 on the Optum Rx News, Follow the Dollar, and #DCLF2025

The vernal equinox also brought a surprising surge of industry updates and noteworthy news you won’t want to miss:

- Blue Shield of California provides a puzzling update to its PBM unbundling effort

- The Stelara biosimilar price war begins

- My reaction to Optum Rx’s pharmacy reimbursement announcement

- A valuable Follow the Dollar primer

P.S. Join my more than 61,000 LinkedIn followers for daily links to neat stuff along with thoughtful and provocative commentary from the DCI community.

Coming soon: PBM Industry Update: Trends, Challenges, and What’s Ahead. Our first webinar of the year will tackle the most controversial drug channel participants. Join Adam J. Fein, Ph.D., on April 4, 2025, from 12:00 p.m. to 1:30 p.m. ET, as he shares his expert analysis on critical industry developments. Click here to learn more and sign up.

Tuesday, March 25, 2025

Reflections and Photos from the Inaugural Drug Channels Leadership Forum 2025

Paula and I are beyond grateful to everyone who took the stage to share their insights and to all who participated in making this event so impactful. (Even Paula got on the main stage!) The event was packed with thought-provoking discussions, candid insights, and dynamic exchanges. The HMP Global team delivered a truly first-class experience for the nearly 350 lucky attendees.

Here are some brief video highlights. Click here if you can't see the video below.

We also had a professional photographer. Here's what happened in the morning of the first day.

You can see more fun photos from the event here on my LinkedIn account:

You can find attendees’ photos by searching “#DCLF2025” on LinkedIn. (Be sure to use quotation marks and then sort by “Latest.”)

BTW, you won’t see any news stories about the DCLF. That’s because the media were not invited and the sessions were not recorded. You had to be in the room where it happened.😉

The DCLF will return in March 2026.

P.S. A special shoutout to the phenomenal HMP Global team. Your hard work and dedication made this event unforgettable!

Monday, March 24, 2025

Informa Connect’s Life Sciences Pricing & Contracting USA

May 19-21, 2025 | Philadelphia, PA

Drug Channels readers save 10% with code 25DRCH10*

Pricing & Contracting USA arrives at an important moment for our industry. As you work to navigate the evolving healthcare landscape, this annual event brings together 60+ expert speakers from 70+ companies to lead the critical discussions that will drive comprehensive market strategy, uniting Medicaid, Policy, Pricing, Contracting & Reporting thought leaders.

With 52 sessions across 6 workshops and 5 tracks, this event features:

- Wholesaler/Manufacturer Team-to-Team Meet-and-Greets: Direct industry collaboration

- Executive Programming: Fireside Chat with External Counsel, Closed Door Executive Strategy Summit and Luncheon

- Interactive Sessions: Speed Networking, AI Lunch and Learn

- Strategic Working Groups: Medicaid Working Group Report, 80 Minute Industry Strategy Working Group

- The Hottest Topics: Covering Government pricing, contracting and reporting fundamentals, MDRP, the Medicaid Final Rule, State Drug Price Transparency, PDAB, Medicaid, VA and IRA penalties, PBM evolution and regulation, 340B challenges, GTN, PhRMA, GPO Management, specialty distribution and cold chain, AI and automation and more.

Join us where Medicaid, Commercial & Government Teams will collaborate to drive a successful market strategy!

View the agenda for Pricing & Contracting USA to see the complete picture – the program, speakers, and more, and visit www.informaconnect.com/pricing-contracting-usa for further details and to register. Drug Channels readers will save 10% off when they use code 25DRCH10 and register prior to April 30, 2025.*

*Cannot be combined with other offers or used towards a current registration. Cannot be combined with special category rates or other offers. Other restrictions may apply.

The content of Sponsored Posts does not necessarily reflect the views of HMP Omnimedia, LLC, Drug Channels Institute, its parent company, or any of its employees. To find out how you can publish an event post on Drug Channels, please contact Paula Fein (paula@DrugChannels.net).

Friday, March 21, 2025

The End of the Blockbuster Era: Unlocking Growth with Direct-to-Patient Commercialization

Greg discusses some of the challenges manufacturers face with product commercialization, patient access and adherence, and negotiating partnerships with pharmacy benefit managers (PBMs). He introduces us to EVERSANA DIRECT Commercialization™, a direct-to-patient change/model.

To learn more about EVERSANA DIRECT Commercialization™ and how the direct-to-patient model can help you, meet with EVERSANA at the Asembia Summit in Las Vegas.

Read on for Greg's insights.

Tuesday, March 18, 2025

NOW AVAILABLE: The 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers

- Download a free 30-page report overview—including key industry trends, What's New in this edition, the Table of Contents, and a List of Exhibits

- Read the press release: HMP Global’s Drug Channels Institute Releases 2025 Economic Report on U.S. Pharmacies and PBMs, Examining $683 Billion Market

Now in its 16th edition, this report remains the most comprehensive, fact-based resource for understanding the entire U.S. drug pricing, reimbursement, and dispensing system. It serves as the ultimate guide to the complex web of interactions within U.S. prescription drug channels.

What's inside?

- 12 chapters, 540+ pages, and 268 exhibits

- Nearly 1,200 endnotes with hyperlinks to source materials

- Substantial new material—outlined on page ix of the report overview

You can pay online using Visa, MasterCard, American Express, Discover, and PayPal. If you prefer to pay by corporate check or ACH, click here to request an invoice.

Want to bundle the report with DCI’s video webinars? Email Paula Fein (paula@drugchannels.net).

If you preordered, you should have received an email with download instructions last week. Didn’t get it? Contact us at dcisupport@hmpglobal.com, and we’ll take care of it.

WHAT’S GOING ON

Twice a year, the DCI team researches and writes two comprehensive, fact-based, and nonpartisan reports on drug channel economics. In some small way, we aim to make the world a slightly smarter place.

Our reports are widely used by nearly every company involved in the drug channel:

- Pharmaceutical manufacturers

- Wholesalers, pharmacists, pharmacy owners

- Hospitals, benefit managers, and managed care executives

- Policy analysts, investors, consultants, and more

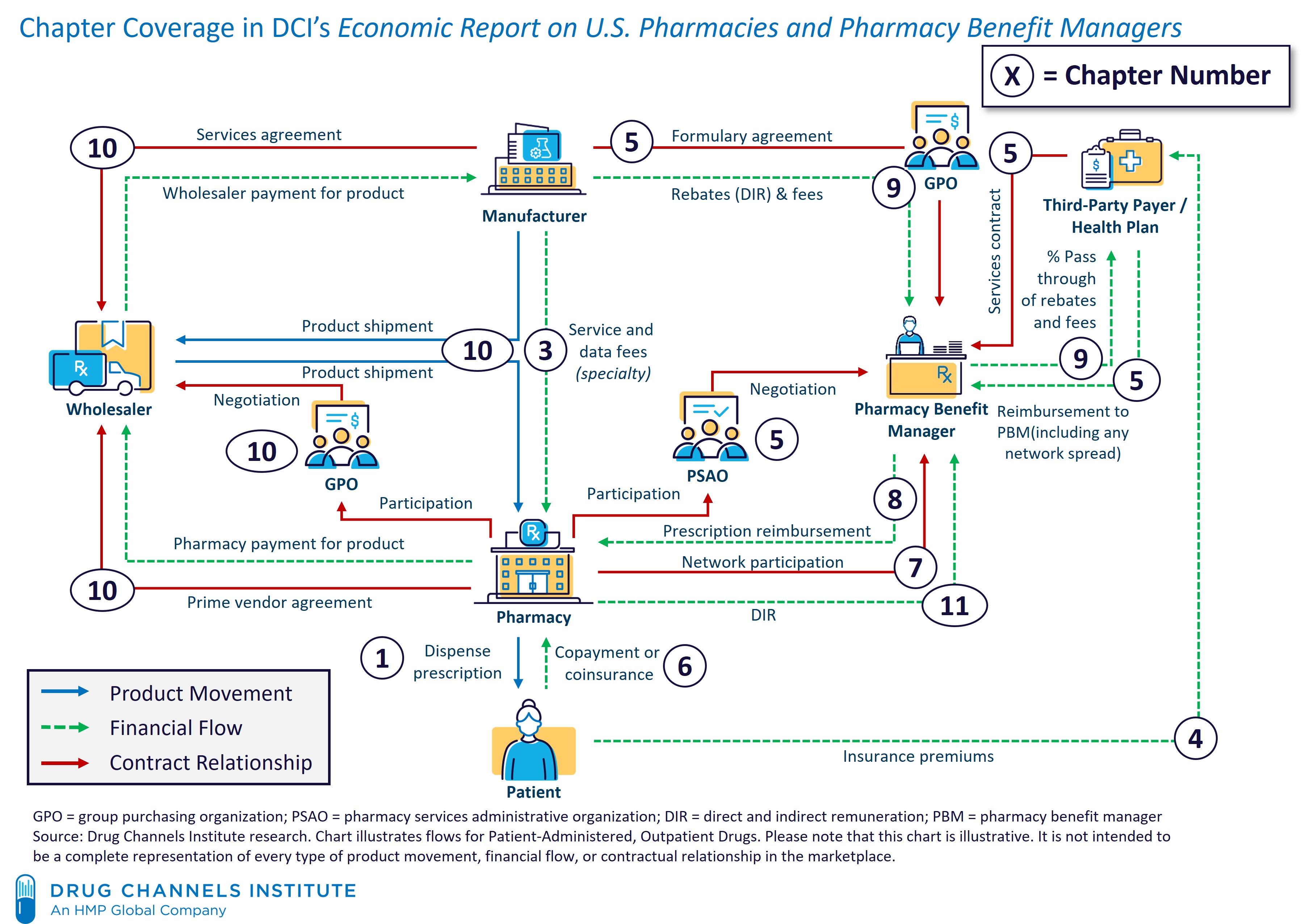

The chart below illustrates the depth and breadth of the 2025 edition, with chapter numbers corresponding to each channel flow.

FUN FACTS ABOUT THE 2025 EDITION

- The 12 chapters are self-contained—you don't need to read them in order. (Really!)

- There are tons of internal hyperlinks to help you navigate and focus on what matters most to you.

- We’ve updated all market and industry data with the most current insights, including our annual analyses of the largest pharmacies, specialty pharmacies, and PBMs.

- Many sections have been expanded and reorganized to better reflect the latest industry developments. Check out the What’s New section in the report overview for details.

- You have the option to download an additional PowerPoint file with images of all 268 exhibits—making it easier to share insights with your team. (Note: All license versions include exhibits within the text.)

- There are a staggering 1,163 endnotes (!), most of which have direct hyperlinks to original source materials, giving you a deeper knowledge base beyond what’s in the report.

- Sadly, I had to remove all corny jokes and pop culture references. So, no memes and absolutely no references to SpongeBob SquarePants.

Enjoy!

Friday, March 14, 2025

Direct-to-Consumer Models: Why They’re Expanding and Where They Deliver the Most Impact

Jordan discusses the uptick in direct-to-consumer (DTC) models for life sciences organizations looking to navigate market challenges and improve patient access. He goes on to describe some potential risks and complexities associated with these models.

To learn about AssistRx’s technology solutions designed to simplify the patient experience and reduce channel costs, meet with AssistRx at the Drug Channels Leadership Forum, Informa Connect’s Access USA, and/or the Asembia Summit.

Read on for Jordan’s insights.

Tuesday, March 11, 2025

The Top 15 U.S. Pharmacies of 2024: Market Shares and Revenues at the Biggest Chains, PBMs, and Specialty Pharmacies

For 2024, DCI estimates that total prescription dispensing revenues at retail, mail, long-term care, and specialty pharmacies reached $683 billion, up 9% from the 2023 figure. GLP-1 agonist drugs remained the most significant driver of prescription revenue at retail pharmacies, accounting for more than 80% of dispensing revenue growth for 2024.

The table below—one of 268 in our new report—cues up DCI's first look at the 15 largest organizations that battled for those revenues. For a sneak peek at the complete report, click here to download our free 30-page report overview (including key industry trends, What's New in this edition, the Table of Contents, and a List of Exhibits). We’re offering special discounted pricing if you order before March 31, 2025.

Will PBMs be able to maintain their position as the leading pharmacies? Find out at my upcoming live video webinar, PBM Industry Update: Trends, Challenges, and What's Ahead, on April 4, 2025, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

Friday, March 07, 2025

Bridging the Gap in Patient Support: How GoodRx is Revolutionizing Access to Specialty Meds

Divya argues that patient support programs (PSPs) struggle with awareness and accessibility, preventing patients from fully benefiting from the financial and educational resources available to them. Divya discusses how integrating digital solutions from GoodRx can enhance engagement, streamline access to therapy, and improve patient outcomes.

To learn more, download the GoodRx Yellow Paper: GoodRx Helps Enable Pharma’s GTM Strategies.

Read on for Divya’s insights.

Wednesday, March 05, 2025

Transparency vs. Reality: Troubling Lessons from PBM Disclosure Laws

While this marks another federal push for disclosure, states have already been quite active in this space. Since 2017, 24 states have passed 38 laws targeting healthcare transparency, with a strong focus on unraveling the complex economics of pharmacy benefit managers (PBMs).

But has all this legislation actually provided clarity—or just more red tape?

Below, I analyze four state reports on manufacturers’ rebate and fee payments to PBMs. The findings are dispiriting: mandated disclosures have yielded little actionable, reliable data. Lawmakers got to pat themselves on the back for “transparency,” but the data tell a different story. Federal efforts haven’t been much better.

Should we continue down the path of government-mandated reporting, or should plan sponsors be left to negotiate their own deals? I’ll explore these questions and more during DCI’s upcoming live video webinar, PBM Industry Update: Trends, Challenges, and What's Ahead on April 4, 2025. Click here to learn more and sign up.

Tuesday, March 04, 2025

PBM Industry Update: Trends, Challenges, and What's Ahead (NEW Live Video Webinar)

PBM Industry Update:

Trends, Challenges, and What's Ahead

This event will be broadcast live on

Friday, April 4, 2025, from 12:00 p.m. to 1:30 p.m. ET

This event is part of The Drug Channels 2025 Video Webinar Series.

WHAT YOU WILL LEARN

Join industry expert Adam J. Fein, Ph.D., for an exclusive deep dive into the latest trends, data, and strategies shaping the pharmacy benefit management (PBM) industry. Drawing from the brand-new 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers, Dr. Fein will provide invaluable insights to help you and your team stay informed about this rapidly evolving market.

Dr. Fein will share his expert analysis on critical industry developments, including:

- The competitive landscape of major PBMs, with exclusive market share data from DCI

- Key business trends among leading PBMs and their impact on the market

- PBMs’ expanding role in specialty pharmacy and how it’s reshaping the industry

- Exclusive insights into the Federal Trade Commission’s interim reports and the future of its investigation

- The evolving role of independent PBMs and their market positioning

- How health-system-owned PBMs are changing the game

- Fresh data on plan sponsors’ perspectives on their PBM partners

- Key takeaways from PBMs’ 2025 commercial formularies

- The latest shifts in PBM compensation models

- The risks and rewards of PBM-affiliated private-label products and GPOs

- Legislative and business implications of the 340B Drug Pricing Program

- State and federal PBM regulations: What’s ahead?

- Emerging controversies, challenges, and threats to watch in the industry

As always, Dr. Fein will clearly distinguish his opinions and interpretations from the objective facts and data.

This 90-minute video webinar will feature a dedicated Q&A session, where attendees can unmute and engage directly with Dr. Fein. Don't miss this unique opportunity to gain actionable insights and have your burning questions answered in real time!

Register now to stay informed and ahead of the curve on the PBM industry!

PRICING OPTIONS

Take advantage of this exclusive educational opportunity for just $420 per viewing device. Once you register, you'll receive a unique Zoom access link within 24 hours—making it easy to add the event to your calendar and ensure you don’t miss out.

SPECIAL DISCOUNTS FOR GROUPS!

We understand that many professionals are working remotely, so we’re offering substantial savings for multiple registrations from the same organization:

- Register multiple devices for as low as $295 each—a 30% discount!

- Unlimited attendees can watch together at a single physical location (one registered device required).

Important Reminder: Each device at a single physical location must have its own registration. The webinar may not be recorded, streamed, or shared across different locations, devices, or sites.

Click here to order. All discounts will be automatically computed based on the number of registrations you enter in your cart. (You can reset the cart by entering 0 in the quantity field.)

Please contact dcisupport@hmpglobal.com if you have any questions. If you purchase access for multiple devices, we will contact you for a list of your participants and their email addresses. Or, download this spreadsheet and email your registrants’ information to dcisupport@hmpglobal.com.

Payment can be made with all major credit cards (Visa, MasterCard, American Express, and Discover) or via PayPal. Click here to contact us if you would like to pay by corporate check or ACH.

IMPORTANT THINGS TO KNOW

- Watch and listen via any device with a web browser (computer, iPad, iPhone/Android, etc.) There is no access via telephone.

- We will use Zoom technology for this webinar. Every registrant will receive an email from Zoom with a link to watch the event. This link is unique to the registrant and can only be accessed once. We recommend that every registrant download the Zoom client software/app.

- The day after the event, every registrant—whether they attended the live event or not—will receive an email from Zoom with information on how to access a video replay of the full event and download Dr. Fein's complete slide deck.

- This event is part of The Drug Channels 2025 Video Webinar Series. If you already purchased access to the 2025 Drug Channels Video Webinar Series, then you should have received an email from Zoom with a link to access the April 4, 2025, event.

- Organizations that purchased corporate access for The Drug Channels 2025 Video Webinar Series will receive a custom, branded signup link so employees can easily register. We will automatically refund payments from anyone at a company with corporate access who purchases a single registration using their corporate email account.

- Each registration for a DCI webinar is valid for a single device at a single physical location. Each device at a physical location requires its own registration. Attendees are not permitted to record, stream, share, or project a DCI webinar to other sites or locations. Purchasers who violate this limitation by recording, streaming, sharing, or projecting a DCI webinar to other sites, devices, or locations will be liable for the full cost of all locations that viewed the webinar. DCI reserves the right to prohibit purchasers who violate our terms from attending future DCI webinars.

- Unfortunately, we are unable to offer refunds.

Friday, February 28, 2025

Patient Care’s Next Big Shift: 80% of Leaders Say This Is the Game Changer

Scott shares key findings from CareMetx’s recent survey of over 100 industry leaders. He explains how such advanced technologies as AI and machine learning will reshape patient services and improve the experience for both patients and healthcare providers.

To view the full survey results, download The 2025 Patient Services Report: Provider Engagement is Make or Break for Success.

Read on for Scott’s insights.

Wednesday, February 26, 2025

Available for Preorder: The 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers

12 chapters, 500+ pages, 268 exhibits, nearly 1,200 endnotes: There is nothing else available that comes close to this valuable resource.

We are providing you with the opportunity to preorder this thoroughly updated, revised, and expanded 2025 edition at special discounted prices. This means that you can be among the first to access our new report. Those who preorder will receive a download link before March 18.

- Download a free 30-page pre-publication overview (including key industry trends, What's New in this edition, the Table of Contents, and a List of Exhibits)

Email Paula Fein (paula@drugchannels.net) if you’d like to bundle the report purchase with access to DCI’s video webinars.

Special preorder and launch pricing discounts will be valid through March 31, 2025.

Read on for more details.

Tuesday, February 25, 2025

Drug Channels News Roundup, February 2025: Part D vs. Pharmacies, Accumulator Madness, Wholesaler Vertical Integration, IRA vs. MDs, and a 340B Cartoon

- How Part D plan sponsors responded to pharmacy DIR changes

- Troubling new data on copay accumulators in marketplace plans

- DCI’s latest vertical integration visualization

- How the IRA will hurt physician practices

P.S. Join my more than 60,000 LinkedIn followers for daily links to neat stuff along with thoughtful and provocative commentary from the DCI community.

Friday, February 21, 2025

From Data Gaps to Revenue Gains: Harnessing the Power of Comprehensive Data to Drive GTN

Thomas discusses the challenges brands face as they manage gross-to-net (GTN) performance while simultaneously enhancing patient access and adherence. He lists the key performance indicators that can help brands improve GTN.

To learn more, watch PHIL’s free on-demand webinar: Four Patient Access Barriers to Address for High-Impact Programs.

Read on for Thomas's insights.

Tuesday, February 18, 2025

Vanishing Act: Why Small Pharmacies Exited Medicare Part D Networks for 2025

A few months ago , DCI highlighted how the largest pharmacy chains are participating as preferred cost sharing pharmacies in the 2025 stand-alone prescription drug plan (PDP) networks. Today, we update our exclusive analysis of how smaller pharmacies are participating via their pharmacy services administrative organizations (PSAOs).

As you will see below, the largest PSAOs have almost fully abandoned PDPs’ preferred networks in 2025. Plans from Humana, WellCare, and UnitedHealthcare will again not have any independent pharmacies participating via PSAOs as preferred pharmacies.

Thanks to the Inflation Reduction Act (IRA), the PDP market is vanishing. Looks like the presence of smaller pharmacies in preferred networks will not be far behind.

Friday, February 14, 2025

Compliance is Futile Without Transparency: 340B, MDRP, MFP Overlap Lead to Iceberg Ahead

Angie describes the compliance challenges that stakeholders face in managing the complex interactions of the 340B Drug Pricing Program, the Medicaid Drug Rebate Program, and IRA’s Maximum Fair Price and inflation rebate provisions. She explains how clean, comprehensive claims data can resolve these issues.

To learn more, register for Kaldreros’ March 4 free webinar: Taking Action Amidst 340B Uncertainty With Truzo.

Read on for Angie’s insights.

Wednesday, February 12, 2025

Why Plan Sponsors and PBMs Are Still Falling Hard for Copay Maximizers

As of late 2024, more than 40% of commercially insured lives were in plans that utilize a copay accumulator or a maximizer. Thanks to a potent combination of payer savings and PBM profits, maximizers are now more beloved than copay accumulators. Check out the data below.

DCI estimates that that plans and their vendors receive about $6.5 billion of manufacturers’ copayment support funds. Given the money at stake, plans will keep wooing this money away from patients. Will legislators let this love continue to bloom? Read on and let me know what you think.