Below, you’ll find Drug Channels Institute's latest estimates of pharmacy benefit manager (PBM) market share based on equivalent prescription claims. I also provide commentary on recent market developments and offer some helpful tips for interpreting the figures.

PBMs are facing unprecedented scrutiny from Congress, state legislatures, and the Federal Trade Commission (FTC)—although the PBMs' largest customers have not been vocally protesting the current marketplace. Tomorrow, I’ll examine one new evolution—the new group purchasing organizations that the largest PBMs have formed.

In the meantime, tune in for more PBM-bashing at today's House hearing: The Role of Pharmacy Benefit Managers in Prescription Drug Markets Part I: Self-Interest or Health Care?

Speaking of PBMs, join me for my new live video webinar, PBMs and the Battle Over Patient Support Funds: Accumulators, Maximizers, and Alternative Funding, on June 23, 2023, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

The market share data shown below come from Chapter 5 of our 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers. The section numbers below refer to this report.

MEET THE 2022 MARKET

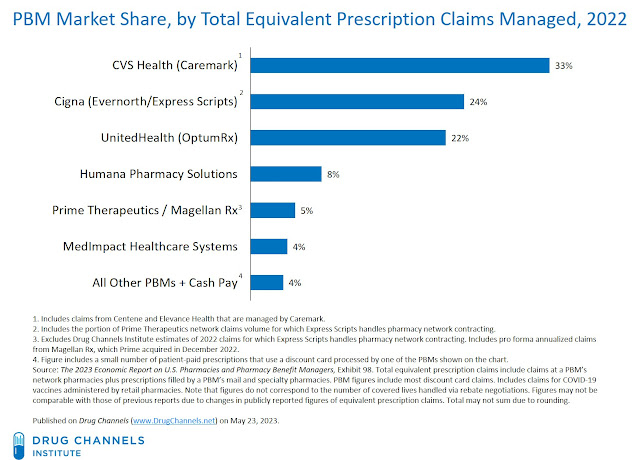

We estimate that for 2022, about 80% of all equivalent prescription claims were processed by three companies: the Caremark business of CVS Health, the Express Scripts business of Cigna, and the OptumRx business of UnitedHealth Group.

[Click to Enlarge]

This concentration reflects the significant transactions and business relationships among the largest PBMs that have further concentrated market share. Five of the six largest PBMs are now jointly owned by organizations that also own a health insurer, as illustrated in Mapping the Vertical Integration of Insurers, PBMs, Specialty Pharmacies, and Providers: A May 2023 Update.

The big three PBMs’ aggregate share of claims was similar to the 2021 figure. Compared with 2021, however, Cigna’s share declined due to customer losses, while OptumRx’s share grew slightly. Two other notable market changes affected the 2022 figures:

- In January 2022, Caremark added the specialty business back to its Federal Employee Program (FEP) mail and clinical pharmacy services contract. The specialty portion of the FEP had transitioned to Prime Therapeutics in 2018.

- In late 2022, Prime Therapeutics completed its acquisition of Magellan Rx from Centene. For 2022, Magellan Rx managed $22.9 billion in drug spend and had annual claims volume of 220.9 million. Magellan Rx annualized claims are included with Prime’s figures above.

IMPORTANT STUFF TO KNOW

There are several important considerations when reviewing the figures above:

- Claims management. The figures for the largest companies include an unknown number of claims from other PBMs. Many smaller PBMs outsource claims processing, pharmacy network management, and prescription fulfillment to one of the three largest PBMs.

Larger PBMs have also consolidated their claims with the Big Three companies. For example, we estimate that for 2022, Cigna’s Express Scripts business handled pharmacy network contracting for about 40% of Prime Therapeutics’ annualized equivalent claims volume. (See How Cigna’s Growing Pharmacy Platform Expands Its Channel Power.) Cigna includes these claims in its total adjusted prescription claims volume. Similarly, CVS Health provides various claims and fulfillment services for Anthem’s IngenioRx business and Centene’s health plans.

- Rebate aggregation. The figures above do not correspond to the number of covered lives handled via rebate negotiations.

Many smaller PBMs do not have the scale to negotiate favorable formulary rebates and may lack a claims processing system. In these situations, a larger PBM acts as an aggregator for these smaller entities. The bigger PBM gets to submit a larger consolidated rebate invoice, and the smaller player gets access to better pricing and a national claims system.

Rebate aggregation also occurs via the large PBMs’ purchasing groups, which handle rebate negotiations with manufacturers and provide other services to manufacturers and the groups’ members. Tomorrow, I’ll examine the three major PBM-owned purchasing groups: Ascent Health Solutions (Cigna/Evernorth), Emisar Pharma Services (UnitedHealth Group/Optum), and Zinc Health Services (CVS Health).

Due to this aggregation, there is substantial double counting when evaluating covered lives. Summing up the figures reported by individual PBMs leads to an aggregate number that greatly exceeds the total U.S. population.

- Discount cards. Patient-paid prescriptions that use a discount card are not considered cash-pay, because the claims are adjudicated by a PBM. A growing share of discount card claims are included within the figures for each PBM. (Watch How Discount Cards Work: A Primer on GoodRx and Its Competitors.) Discount cards accounted for nearly 6% of equivalent prescription claims activity in 2022. (See Exhibit 86 in our 2023 pharmacy/PBM report.)

As I warned last year, anyone expecting massive market disruption should lower their expectations. We may be forced to live with our current PBM market’s golden rule: Whoever has the gold gets to make the rules.

No comments:

Post a Comment