- Foul ball: OptumRx prefers higher prices for the first Humira biosimilar (SEE UPDATE BELOW)

- Strikeout: Copay accumulators hurt health equity

- Bench warmer: Surprise? Amazon has still not disrupted healthcare

- Spitting mad: Shady alternative funding programs (AFPs) face more scrutiny

P.S. Join my nearly 41,000 (!) LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter, where I have more than 16,000 followers. (I recommend that you follow me on LinkedIn, because the quality of comments is much, much higher than they are on Twitter.)

Pharmacy Passages: Formulary Update (February 2023), OptumRx

As you may recall, Amgen recently launched Amjevita, the first non-interchangeable biosimilar of Humira. Our crazy drug channel led Amgen to launch both a high-list/high-rebate and a low-list/low-rebate version of the drug. See The Warped Incentives Behind Amgen’s Humira Biosimilar Pricing–And What We Can Learn from Semglee and Repatha.

I’m sad to report that PBMs are behaving true to form:

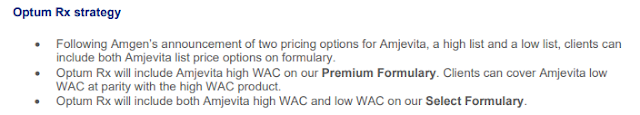

CORRECTION: Following the publication of today’s article, OptumRx revised its formulary language. Here is the updated language:

OptumRx told me: “The low list NDC is not excluded and to ensure there is no confusion we clarified the language on our provider portal to reflect this. As we have shared previously, our clients have the choice to add or substitute the low list Amjevita NDC to either the Optum Rx Premium or Select formularies. The Premium Formulary simply defaults to the high WAC NDC based on client feedback and preference and can easily be configured to add in low WAC NDCs.” The link above now points to the updated document.

In a related disappointment, CVS Health admitted "plan sponsors will benefit from significant savings" of biosimilars. Biosimilars in the autoimmune category: Opportunities and considerations, the PBM’s eight-page primer on Humira biosimilars, barely deigns to mention how biosimilars will affect patients. Oops?

I’m sad to report that PBMs are behaving true to form:

- On the OptumRx Premium Formulary, the high-price version has been placed on Tier 2, while the low-price version is excluded from the formulary.

- On the OptumRx Select Formulary, the higher-price version has been placed on Tier 2, while the lower-price version landed on Tier 3. But to get access to the lower-priced version, patients have to first try both Humira and the high-price version.

Huh? Will the prior authorization form for Amjevita (Low WAC) ask: “Does the patient have a failure, intolerance, or contraindication to a high WAC instead of a low WAC?” (h/t Sheevum Patel)

[Click to Enlarge]

CORRECTION: Following the publication of today’s article, OptumRx revised its formulary language. Here is the updated language:

[Click to Enlarge]

OptumRx told me: “The low list NDC is not excluded and to ensure there is no confusion we clarified the language on our provider portal to reflect this. As we have shared previously, our clients have the choice to add or substitute the low list Amjevita NDC to either the Optum Rx Premium or Select formularies. The Premium Formulary simply defaults to the high WAC NDC based on client feedback and preference and can easily be configured to add in low WAC NDCs.” The link above now points to the updated document.

In a related disappointment, CVS Health admitted "plan sponsors will benefit from significant savings" of biosimilars. Biosimilars in the autoimmune category: Opportunities and considerations, the PBM’s eight-page primer on Humira biosimilars, barely deigns to mention how biosimilars will affect patients. Oops?

Assessing the Relationship Between Copay Adjustment Program Exposure and Household Income Levels in a Cohort of Patients With Schizophrenia, Janssen

Get ready to be outraged.

New research finds that households with lower incomes are more likely to be exposed to copay accumulators. In other words, plans and PBMs double dip on deductible payments from the people least able to afford it.

You can find the latest data on the growth of these benefit “innovations” here: Copay Accumulator and Maximizer Update: Adoption Plateaus as Insurers Battle Patients Over Copay Support.

New research finds that households with lower incomes are more likely to be exposed to copay accumulators. In other words, plans and PBMs double dip on deductible payments from the people least able to afford it.

[Click to Enlarge]

You can find the latest data on the growth of these benefit “innovations” here: Copay Accumulator and Maximizer Update: Adoption Plateaus as Insurers Battle Patients Over Copay Support.

Amazon grew relentlessly. Now it’s getting lean., The Washington Post

Disruption delayed—again.

The Washington Post, which is owned by Jeff Bezos, took some shots at Amazon’s limited healthcare impact. Here’s the key section from the article:

As Drug Channels' readers know, I’ve long been skeptical of Amazon’s pharmacy/PBM impact. Amazon is the second-largest retailer in the United States, after Walmart. It is logical that the company will continue to seek market share within the $550 billion pharmacy industry.

But unless Amazon embarks on a truly disruptive strategy, its overall share of the prescription dispensing market will remain in the low single digits for the foreseeable future.

The Washington Post, which is owned by Jeff Bezos, took some shots at Amazon’s limited healthcare impact. Here’s the key section from the article:

“Amazon Pharmacy, which grew out of Amazon’s acquisition of Pillpack, has struggled to gain traction, a former employee who spoke on the condition of anonymity said. Amazon has tried to increase interest by offering discounted subscriptions like RxPass.Many people have been obsessed with the notion that Amazon will undertake as-yet-undiscovered amazing strategies that will destroy the pharmacy and PBM industries. And far too many credulous consultants tried to scare people with that goofy photoshop of Jeff Bezos wearing a white coat and stethoscope.

But the pharmacy team still hasn’t launched some of the features that made Pillpack popular, like prescriptions conveniently shipped in daily packets. The logistics of running a medical business have been tricky — for example, Amazon can’t ship drugs through its existing logistics network, a second former employee said. And integrating Pillpack’s technology into Amazon’s complex and clunky back end software was a long and arduous process, three former employees said. Overall, former employees said the company underestimated how complex running a health care business would be.” (emphasis added)

As Drug Channels' readers know, I’ve long been skeptical of Amazon’s pharmacy/PBM impact. Amazon is the second-largest retailer in the United States, after Walmart. It is logical that the company will continue to seek market share within the $550 billion pharmacy industry.

But unless Amazon embarks on a truly disruptive strategy, its overall share of the prescription dispensing market will remain in the low single digits for the foreseeable future.

Drugmakers push back on a clever tactic employers use to avoid paying for specialty medicines, STAT

In The Shady Business of Specialty Carve-Outs, a.k.a., Alternative Funding Programs (AFPs), I outlined the schemes by which plan sponsors grab charity support intended for uninsured and indigent patients.

The STAT article linked above highlights drugmakers’ tactics in defending against the AFP vendors. ICYMI, I highlighted Abbvie’s approach in the March news roundup.

I’m quoted in the article about the under-the-radar firms that facilitate the looting of patient assistance programs:

The STAT article linked above highlights drugmakers’ tactics in defending against the AFP vendors. ICYMI, I highlighted Abbvie’s approach in the March news roundup.

I’m quoted in the article about the under-the-radar firms that facilitate the looting of patient assistance programs:

“These companies hide in the shadows, and their websites are ambiguous and vague. The amount of money they’re making is totally disproportionate to the value they bring. There are so many entities in the system leeching the money away. It’s one more thing people don’t understand about how the drug channel system works.”Expect much more controversy as the AFPs expand into larger plan sponsors.

Mark Cuban

During a recent trip to Dallas, I had the opportunity to sit down with entrepreneur Mark Cuban. We chatted about the complexities and warped incentives of the U.S. drug channel. Mark was kind enough to share his vision for the Mark Cuban Cost Plus Drug Company and how he wants to change the system.

We also took this great photo, which has become my most liked and viewed post on LinkedIn. At the time of this article's publication, the post had more than 200,000 views and 2,300 reactions.

ICYMI, I shared my thoughts on patient-paid prescriptions during last month’s video webinar: Discount Cards, Cost-Plus Pharmacies, and PBMs: Trends, Controversies, and Outlook.

We also took this great photo, which has become my most liked and viewed post on LinkedIn. At the time of this article's publication, the post had more than 200,000 views and 2,300 reactions.

[Click to Enlarge]

ICYMI, I shared my thoughts on patient-paid prescriptions during last month’s video webinar: Discount Cards, Cost-Plus Pharmacies, and PBMs: Trends, Controversies, and Outlook.

No comments:

Post a Comment