Friday, March 31, 2023

Brand-Name Drug Prices Fell for the Fifth Consecutive Year—And Plummeted After Adjusting for Inflation (rerun)

Click here to see the original post and comments from January 2023.

Time for the Drug Channels annual reality check on drug pricing. The data once again tell a different story than you might read in your favorite politician’s Twitter feed or misleading news reports.

For 2022, brand-name drugs’ net prices dropped for an unprecedented fifth consecutive year. What’s more, after adjusting for overall inflation, brand-name drug net prices plunged by almost 9%.

The factors behind declining drug prices will remain in the coming years—and become even stronger due to forthcoming changes in Medicare and Medicaid. Employers, health plans, and PBMs will determine whether patients will share in this ongoing deflation.

Read on for details and make up your own mind. And please pass the news along to the drug pricing flat earthers (#DPFE) who refuse to accept that brand-name drug prices are falling—or that prescription drug spending is a small and stable portion of overall U.S. healthcare expenditures.

Even a purple gorilla professor understands these facts.

Thursday, March 30, 2023

The Warped Incentives Behind Amgen’s Humira Biosimilar Pricing–And What We Can Learn from Semglee and Repatha (rerun)

So far, it appears that PBMs are neither preferring Amgen's Humira biosimilar nor embracing the low-list/low-rebate version. In February, AbbVie stated that U.S. Humira sales would be decline by about 37% in 2023—which is at the lower end of its previous erosion projection of 35% to 55%. Much more to come. Click here to see the original post and comments from February 2023.

As you've surely heard, Amgen has just launched Amjevita, the first non-interchangeable biosimilar of Humira. Our crazy drug channel led Amgen to launch both a high-list/high-rebate and a low-list/low-rebate version of the drug. Its strategy echoes the pricing of the first interchangeable insulin biosimilars—as I predicted in 2021.

Unfortunately, we should expect most PBMs and plan sponsors to embrace the high-list/high-rebate version. The plans that adopt the higher-priced biosimilar will get bigger rebates, while patients with coinsurance and deductibles end up paying more out-of-pocket.

As Mark Twain said: “History doesn’t repeat itself—but it often rhymes.” So, below, I revisit the surprising market dynamics for the interchangeable insulin biosimilars and highlight Amgen’s experience lowering the list price of its PCSK9i product. The story is more complex than you might expect, so perhaps there is hope that low-list-price versions will connect.

Wednesday, March 29, 2023

CVS, Walgreens, and Walmart Keep Position in 2023 Part D Preferred Networks—While Kroger Bails Over its Express Scripts Blowup (rerun)

One follow-up to this rerun: Kroger’s participation as a preferred pharmacy declined significantly due to its Express Scripts relationship. Based on early 2023 enrollment data, Kroger is preferred in plans that enrolled only 11.8 million people—a decline of 33% from the 2022 figure. See Exhibit 154 of our new 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Click here to see the original post and comments from December 2022.

In Preferred Pharmacy Networks in 2023’s Medicare Part D Plans: Cigna, CVS Health, Humana, UnitedHealthcare, WellCare, and More, I highlighted how those networks have taken over the world of stand-alone Medicare Part D prescription drug plans (PDP) and become a major presence in Medicare Advantage prescription drug (MA-PD) plans.

Today, I examine the seven largest retail chains’ 2023 participation in the 22 major 2023 Part D preferred networks that the eight largest plan sponsors will offer. As always, I offer you a handy table for scoring each chain’s participation and changes from 2022 to 2023.

As you’ll see, Kroger’s decision to exit Express Scripts commercial pharmacy networks has had negative ramifications for its Part D position. Kroger will be out-of-network—not just non-preferred—in the major Part D networks for which Express Scripts acts as the PBM. That will be a key factor behind its $1+ billion revenue hit.

Tuesday, March 28, 2023

The Big Three PBMs’ 2023 Formulary Exclusions: Observations on Insulin, Humira, and Biosimilars (rerun)

Click here to see the original post and comments from January 2023.

For 2023, the three largest pharmacy benefit managers (PBMs)—Caremark (CVS Health), Express Scripts (Cigna), and OptumRx (United Health Group)—have again increased the number of drugs they exclude from their standard formularies.

Each exclusion list now contains about 600 products. Growth in the number of excluded drugs slowed for the second year, due partly to the fact that so many drugs have already been dropped from PBMs’ formularies.

Below, I highlight four takeaways from this year’s lists, including a look at biosimilar insulin and the forthcoming biosimilar competition for Humira. I also note some troubling research on the patient impact of exclusions—although much remains unknown.

As always, I welcome your comments below or on social media.

Monday, March 27, 2023

Behind the GoodRx-Express Scripts Partnership: How PBMs Profit from Discount Cards in Pharmacy Benefits (rerun)

Click here to see the original post and comments from November 2022.

Last week, GoodRx announced that it would become the exclusive prescription discount card provider for the commercial beneficiaries of Cigna’s Express Scripts. Links below.

The rise of discount card pricing within pharmacy benefit plans is a positive development. Patients get access to market prices that can be lower than their PBM’s contracted rate. All out-of-pocket spending with a discount card counts toward a patient's deductibles, and all prescription activity gets captured.

However, I suspect few people understand that placing discount cards within the pharmacy benefit enables a PBM to monetize a new fee stream from the card vendor. Below, I walk through this booming business and highlight some of the conflicts and contradictions underneath the coconuts.

Friday, March 24, 2023

Winning the Race for Patient Access: Identifying Copay Accumulator Impact

Logan discusses the financial impacts of copay accumulators on manufacturers and patients. She describes how to reduce the strain on manufacturers' programs while also increasing patient access. Click here to learn about the Paysign Solution.

Email affordability@paysign.com to set up a meeting with Paysign at Asembia’s Specialty Pharmacy Summit, April 30-May 4.

Read on for Logan’s insights.

Tuesday, March 21, 2023

Drug Channels News Roundup, March 2023: My $0.02 on Insulin Price Cuts, AbbVie vs. AFPs, Optum Expands, ASAP340B, and Hooray for Pharmacists

- Thoughts on the recent insulin price cuts by Lilly, Novo, and Sanofi

- AbbVie gets tougher on alternative funding programs

- Optum quietly adds a new drug channel role

- A novel partnership emerges to modernize the 340B program

P.S. Join my more than 38,000 LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter, where I have more than 16,000 followers.

Join me for my new live video webinar, Discount Cards, Cost-Plus Pharmacies, and PBMs: Trends, Controversies, and Outlook, on March 31, 2023, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

Monday, March 20, 2023

Informa Connect’s Annual Life Sciences Commercial Contracts & Chargebacks Congress

May 16-17, 2023

The Omni Shoreham Hotel | Washington, DC

Hybrid Event

informaconnect.com/contracts-chargebacks

Exclusive Offer for Drug Channels Readers: Register Now to SAVE 10%* using promo code 23DC10

Informa Connect’s 19th Annual Commercial Contracts & Chargebacks Congress, taking place May 16-17 in Washington, DC, offers crucial updates on policy changes and contracting best practices to increase efficiency, reduce revenue leakage, and streamline chargeback excellence. This annual event has become a must-attend for pricing and contracting professionals in the life sciences industry with seasoned leaders and forward-thinking strategies on display. Join industry stakeholders, including manufacturers, wholesalers, GPOs and more, for a robust two-day event offering extended content and actionable strategies in key interest areas in the ever-evolving contracting landscape.

Featured Faculty Driving the Conversation:

- Rosalind Davis, Government Pricing & Contracts Director, Vifor Pharma, Inc.

- Stephani Kupski, Director, U.S. Pricing & Government Reporting, CSL Behring

- Mallory O’Connor, Public Policy Executive Director, Mallinckrodt

- Cad Snyder, Director, Global Finance Shared Services, Cardinal Health

- Beth Stevens, Associate Director, Contracts and Pricing, Tolmar Inc.

- Roxana Santiago, Director Controlling Revenue Accounting, Fresenius Kabi USA LLC

- Jennifer Plemmons Crosswell, Director, Contracts & Pricing, Accounting, Azurity Pharmaceuticals

- Mitesh Ghia, Director, Chargebacks, Membership, Rebates & Contract Administration, Novartis Pharmaceuticals Corporations

- Elizabeth Johnson, President, National Association of Medication Access & Patient Advoacacy

- Erika Chiles-George, Pricing & Trade Director, Contracts, Neurocrine Biosciences

- And many more!

- Commercial Contract Model Landscape

- Assessing the Impact of IRA on Product Calculations

- 340B Drug Discount Program — Ongoing Monitoring of 340B Program Risks & Best Practices

- Multi-Stakeholder Panel — Membership and Class of Trade

- Updated Review and Interpretation of the Inflation Reduction Act

- GTN Forecasting Across Different Channels

- PLUS! — Customize Your Learning by Choosing Between Two Thought-Provoking Tracks:

- Contracts and Chargebacks Excellence

- Analytical and Technology Innovation

- and more!

ENHANCE YOUR EXPERIENCE!

Attendees of Commercial Contracts & Chargebacks 2023 have the option to add a third day of content to their schedule and join the Medicaid & Government Pricing Congress attendees for their final day. Benefit from a fireside chat, in-depth sessions and learning streams, plus additional networking opportunities!

Drug Channels readers are eligible for an exclusive savings of 10% off* the standard rate by using promo code 23DC10, so download the complete conference agenda and reserve your seat today!

*Expires 5/16/2023; applies to current rate only and may not be combined or applied to existing registrations; other restrictions may apply

The content of Sponsored Posts does not necessarily reflect the views of Pembroke Consulting, Inc., Drug Channels, or any of its employees. To find out how you can promote an event on Drug Channels, please contact Paula Fein (paula@drugchannels.net).

Friday, March 17, 2023

It's Not All Bad News: Data Shows There's a Collaborative Future for 340B

Rhiannon discusses the growing collaboration between manufacturers and covered entities regarding 340B discount claims. She goes on to describe the Kalderos Discount Hub solution that reviews claims that have a high likelihood of being a duplicate discount.

To stay up-to-date with the latest drug discount developments, sign up for the Kalderos newsletter.

Read on for Rhiannon’s insights.

Tuesday, March 14, 2023

NOW AVAILABLE: The 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers

- Click here to download a free report overview (including key industry trends, the Table of Contents, and a List of Exhibits)

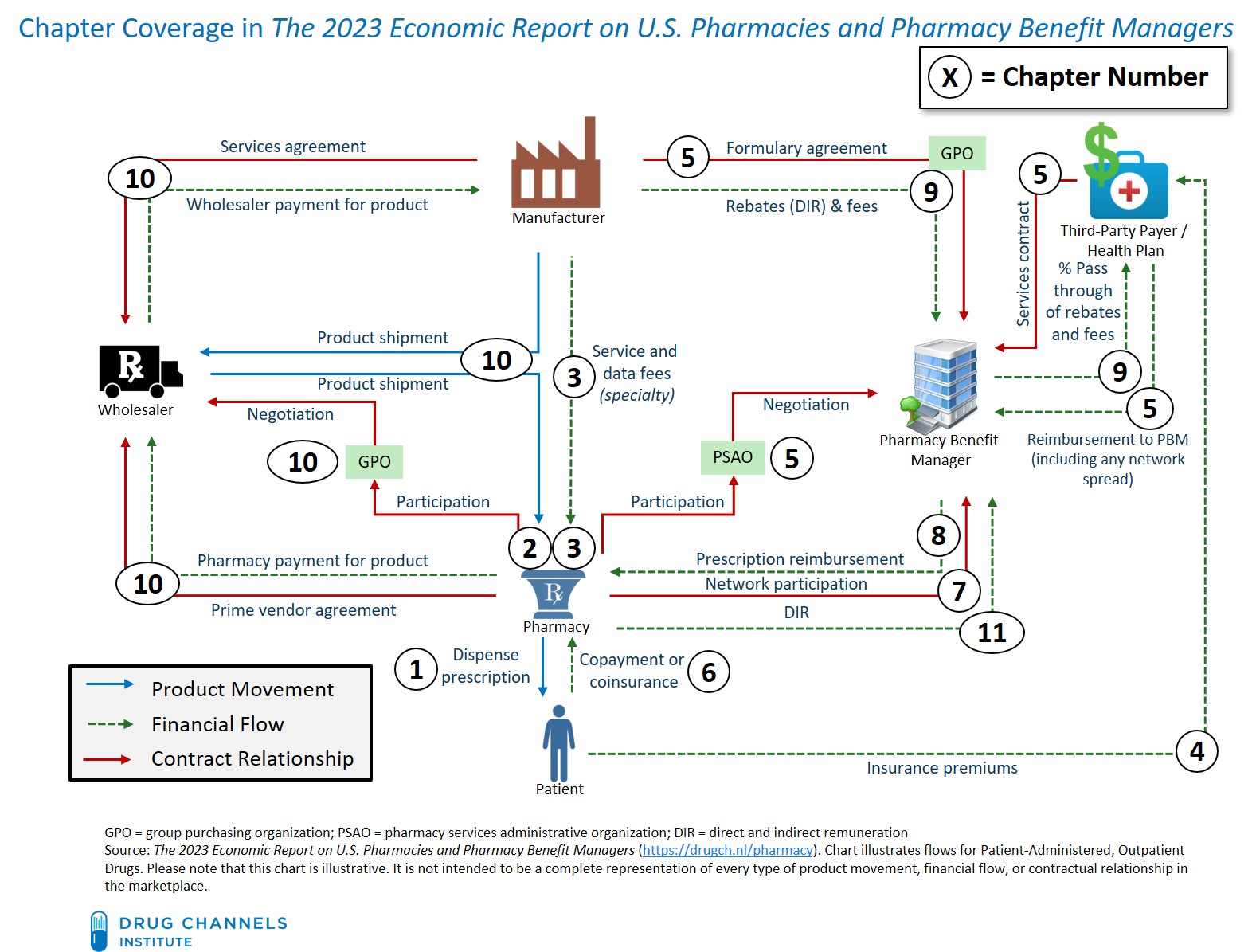

The 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers, our 14th edition, provides a comprehensive, fact-based, and non-partisan tool for understanding the entire U.S. drug pricing, reimbursement, and dispensing system. The report has been thoroughly updated with the latest data and includes loads of new material and new sections.

12 chapters, 480+ pages, 241 charts/exhibits/data tables, 966 endnotes: There is nothing else available that comes close to this encyclopedic resource.

The chart below illustrates the depth and breadth of the 2023 edition. The numbers indicate the report chapter that corresponds to, explains, and analyzes each channel flow.

If you would like to pay by corporate purchase order or check, please email Tamra Feldman. If you preordered the report, you should have already received an email with download instructions last week. Please contact us if you did not receive the email.

Read on for some additional details.

Monday, March 13, 2023

Informa Connect’s Medicaid & Government Pricing Congress

May 16-18, 2023 in Washington, DC

www.informaconnect.com/medicaid2023

Drug Channels readers save 10% with code 23DRCH10*

Join the life science industry on May 16-18, 2023 in Washington, DC at the Medicaid & Government Pricing Congress to conquer complex Medicaid regulatory guidelines and evolve strategies to contract, report and comply with federal and state healthcare programs.

View the agenda for Medicaid & GP 2023 to see the complete picture – the program, speakers, and more, and visit www.informaconnect.com/medicaid-government-pricing for further details and to register. Drug Channels readers will save 10% off when they use code 23DRCH10 and register prior to April 7, 2023.*

When you join Informa Connect in Washington, DC, you'll hear from leading GP experts on the latest MDRP trends and strategies that impact you and your business. Some of the companies leading the dialogue include Ascendis Pharma, AstraZenca, Bayer, Blueprint Medicines, Bristol Myers Squibb, CSL Behring, Department of Health & Human Services, Endo, Genentech, Gilead, Mallinckrodt, Neurocrine Biosciences, Novartis, Pfizer, PhRMA, Sanofi, Takeda, Teva, UCB, United Therapeutics, Viatris and more.

Here are just a few of the sessions you'll attend:

- Everything Inflation Reduction Act – Both interpretation and implementation guidance

- Your Medicaid wish list – 30+ years into the program, what would your recommendations to CMS be?

- The latest and greatest 340B litigation and operational updates

- Refresh of the inclusion of territories, and hear from Puerto Rico Medicaid on their processes

- Panel on market access and pricing strategy considerations for early R&D

- Join a senior-level work group on policy reform for Medicaid and government pricing programs

- Discuss the intersection of line extensions and AMP cap in-depth

- Back by popular demand – Fundamentals of GP, the fireside chat with external counsel, and the state-by-state review of SPTR

- Topics on class of trade, strategies for product launch, moving your data to the cloud, intro to blockchain for GP professionals, discussion on bots and automation and much more!

View the agenda for Medicaid & GP 2023 to see the complete picture – the program, speakers, and more, and visit www.informaconnect.com/medicaid-government-pricing for further details and to register. Drug Channels readers will save 10% off when they use code 23DRCH10 and register prior to April 7, 2023.*

*Cannot be combined with other offers or used towards a current registration. Cannot be combined with special category rates or other offers. Other restrictions may apply.

The content of Sponsored Posts does not necessarily reflect the views of Pembroke Consulting, Inc., Drug Channels, or any of its employees. To find out how you can promote an event on Drug Channels, please contact Paula Fein (paula@drugchannels.net).

Friday, March 10, 2023

Taking A Technology-First Approach In Your Affordability Program

Stacey discusses digital hubs and the affordability advantages they offer both patients on specialty therapies and their health care providers. To learn more, click here to schedule a meeting with AssistRx at Asembia’s Specialty Pharmacy Summit on April 30 to May 4, 2023.

Download AssistRx's free 61-page eBook here: Specialty Drug Patient Support Programs: 2022 Progress Report.

Read on for Stacey’s insights.

Wednesday, March 08, 2023

The Top 15 U.S. Pharmacies of 2022: Market Shares and Revenues at the Biggest Companies

The exhibit below—one of 241 in our new report—provides a first look at the 15 largest organizations, ranked by total U.S. prescription dispensing revenues for calendar year 2022. U.S. prescription dispensing revenues reached a record $548 billion in 2022.

Not to put too fine a point on it—but they might be giants. The largest 15 pharmacies accounted for more than 75% of total dispensing revenues from retail, mail, long-term care, and specialty pharmacies. The top 15's share dipped slightly compared with their 2021 share, due primarily to the significant revenue losses for Walgreens Boots Alliance’s AllianceRx Walgreens Pharmacy.

For a sneak peek at the complete report, click here to download our free report overview (including key industry trends, the table of contents, and a list of exhibits). We’re offering special discounted pricing if you order before April 3, 2023.

How will GoodRx and Mark Cuban Cost Plus Drug Company affect the pharmacy industry? Find out at my upcoming live video webinar, Discount Cards, Cost-Plus Pharmacies, and PBMs: Trends, Controversies, and Outlook, on March 31, 2023, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

Tuesday, March 07, 2023

Discount Cards, Cost-Plus Pharmacies, and PBMs: Trends, Controversies, and Outlook (NEW Live Video Webinar)

Discount Cards, Cost-Plus Pharmacies, and PBMs:

Trends, Controversies, and Outlook

This event will be broadcast live on Friday, March 31, 2023,

from 12:00 p.m. to 1:30 p.m. ET.

This event is part of The Drug Channels 2023 Video Webinar Series. Anyone who registered for the entire series will receive an email with a link to access the March event.

WHAT YOU WILL LEARN

The rapid expansion of patient-paid prescriptions—via cash-pay pharmacies and discount card vendors—is transforming the prescription market. Join Dr. Fein as he helps you and your team deepen their understanding of this important issue and its crucial implications. He will draw from exclusive information found in DCI's new 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

During the event, Dr. Fein will cover a wide range of topics, including:

- What’s driving the boom in patient-paid prescriptions

- The warped economics of the generic prescription channel

- Cash-pay prescriptions vs. discount cards

- Why Usual & Customary (U&C) prices matter

- The latest market data on the discount card market and its key participants

- The complex economics of discount cards

- How PBMs profit from—and are challenged by—patient-paid prescriptions

- Pharmacy strategies and reactions

- Why and how plans are placing discount cards within pharmacy benefits

- Commentary on GoodRx, Mark Cuban Cost-Plus Drug Company, and more

- Outlook for disruption of the pharmacy benefit market

- Controversies and unresolved questions

- And more!

As always, Dr. Fein will clearly distinguish his opinions and interpretations from the objective facts and data.

Read on for full details on pricing and registration.

PRICING OPTIONS

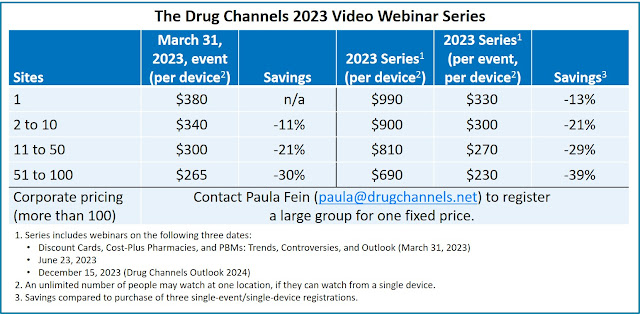

You can register for this unique educational opportunity for only $380 per viewing device. Within 24 hours of your purchase, you will receive an email from Zoom with a unique link to access the webinar replay video.

We are offering substantial discounts for multiple registrations from the same organization. We know that many of you may still be working from home, so rates for multiple registrations are as low as $265 per device—a 30% savings. An unlimited number of people may watch at one location if they can watch from a single device.

Click here to order. All discounts will be automatically computed based on the number of registrations you enter in your cart. (You can reset the cart by entering 0 in the quantity field.)

Please contact Paula Fein (paula@drugchannels.net) if you have any questions. If you purchase access for multiple devices, we will contact you for a list of your participants and their email addresses. Or, download this spreadsheet and email your registrants’ information to Tamra Feldman (admin@drugchannels.net).

Click here to register for the full Drug Channels 2023 Video Webinar Series

Payment can be made with all major credit cards (Visa, MasterCard, American Express, and Discover) or via PayPal. Click here to email us if you would like to pay by corporate purchase order or check.IMPORTANT THINGS TO KNOW

- Watch and listen via any device with a web browser (computer, iPad, iPhone/Android, etc.) There is no access via telephone.

- We use Zoom technology for this webinar. Every registrant will receive an email from Zoom with a link to watch the event. This link is unique to the registrant and can only be accessed once. We recommend that every registrant download the Zoom client software/app.

- Prior to the event, every registrant will receive an email from Zoom with a link to access the event and add it to their calendar. Every registrant will also receive reminder emails from Zoom one week, one day, and one hour before the event.

- This event is part of The Drug Channels 2023 Video Webinar Series. If you have already purchased the full series, you should have received an email from no-reply@zoom.us with your unique link to access the event.

- Organizations that purchased corporate access for The Drug Channels 2023 Video Webinar Series will receive a custom, branded signup link so employees can easily register. We will automatically refund payments from anyone at a company with corporate access who purchases a single registration using their corporate email account.

- Unfortunately, we are unable to offer refunds.

Monday, March 06, 2023

Informa Connect’s Drug Pricing Transparency Congress

May 16-17, 2023 in Washington, DC

Drug Channels readers can save 10% with code 23DRCH10

www.informaconnect.com/drug-pricing-transparency

Join Informa Connect on May 16-17, 2023 in Washington, DC at the Drug Pricing Transparency Congress to stay on the pulse of federal and state reporting requirements, policy initiatives and strategic best practices for compliance. Experts from across the industry will discuss how current and future drug pricing transparency regulations will impact commercialization, reimbursement, pricing and compliance practices. Plus, assess how companies are internally planning for these changes.

View the agenda for Drug Pricing Transparency 2023 to see the complete picture – the program, speakers, and more, and visit www.informaconnect.com/drug-pricing-transparency for further details and to register. Drug Channels readers will save 10% off when they use code 23DRCH10 and register prior to March 31, 2023.*

Here's just a little sneak peek at what's to come:

- You'll hear perspectives from the who's who in drug pricing and transparency, including companies such as Actelion, Ascendis Pharma, BIO, Chiesi, ClassOne Insight, Endo, Gilead Sciences, Hyman, Phelps & McNamara, iContracts, King & Spalding, Latham & Watkins, Mallinckrodt, Maryland Prescription Drug Affordability Board, Model N, Neurocrine Biosciences, Novartis, Novo Nordisk, PhRMA, Porzio Life Sciences, Riparian, Sanofi, Teva, U.S. Attorney's Office for the Districts of MA and NJ, and Viatris

- You'll take a deep dive into the hottest topics keeping you up at night, including

- Drug Pricing Transparency Pressures

- DOJ Drug Pricing Transparency Priorities

- Legal Updates on Authorized Generics and the U.S. Drug Pricing of Brand Name Drugs

- Resource Allocation for Your Medicaid, Market Access and GP Teams

- Updated Review Including CMS Guidance of the Inflation Reduction Act

- Implication of Stacked and Value Based Contract Product Agreements on Medicaid Pricing

- And much more!

View the agenda for Drug Pricing Transparency 2023 to see the complete picture – the program, speakers, and more, and visit www.informaconnect.com/drug-pricing-transparency for further details and to register. Drug Channels readers will save 10% off when they use code 23DRCH10 and register prior to March 31, 2023.*

*Cannot be combined with other offers or used towards a current registration. Cannot be combined with special category rates or other offers. Other restrictions may apply.

The content of Sponsored Posts does not necessarily reflect the views of Pembroke Consulting, Inc., Drug Channels, or any of its employees. To find out how you can promote an event on Drug Channels, please contact Paula Fein (paula@drugchannels.net).

Friday, March 03, 2023

What a Technology-First Approach Really Means for Your Patient Support Program

Jan discusses digital hubs and the benefits they offer both patients on specialty therapies and their health care providers. To learn more, download AssistRx's free 61-page eBook: Specialty Drug Patient Support Programs: 2022 Progress Report.

Read on for Jan’s insights.