ICYMI, the Health Resources and Services Administration (HRSA) finally got tired of my Freedom of Information Act (FOIA) requests. Shortly after I published the article below, HRSA posted public data about 340B covered entity purchases on its website. Alas, HRSA neglected to post any historical data. Fortunately, my 2022 FOIA efforts (described below) extracted purchases by 340B covered entity type for 2015 through 2021.

Click here to see the original post and comments from August 2022.

Here’s a summer surprise for fans of the 340B Drug Pricing Program: Drug Channels has just obtained the 2021 figures from the Health Resources and Services Administration (HRSA)! Even better, my Freedom of Information Act (FOIA) request was able to pry out detailed purchases by covered entity type.

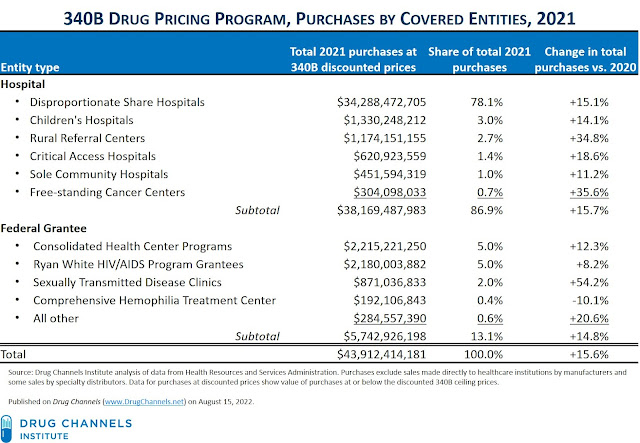

The data tell a familiar story. For 2021, discounted purchases under the 340B program reached a record $43.9 billion—an astonishing $5.9 billion (+15.6%) higher than its 2020 counterpart. Hospitals accounted for 87% of these skyrocketing 340B purchases.

What’s more, the difference between list prices and discounted 340B purchases also grew, to $49.7 billion (+$7.0 billion). This figure approximates the money collected by 340B covered entities.

340B advocates have been screaming that “drug companies are cutting 340B,” but the data tell a very different story. Only in the U.S. healthcare system can billions more in payments and spreads be considered a cut.

Read on for full details and analysis, including the opportunity to download your very own copy of the raw data from HRSA.

I ♥ DATA

Apexus, the HRSA-designated Prime Vendor, reports purchases under the 340B Drug Pricing Program to HRSA and oversees most aspects of the program’s management.

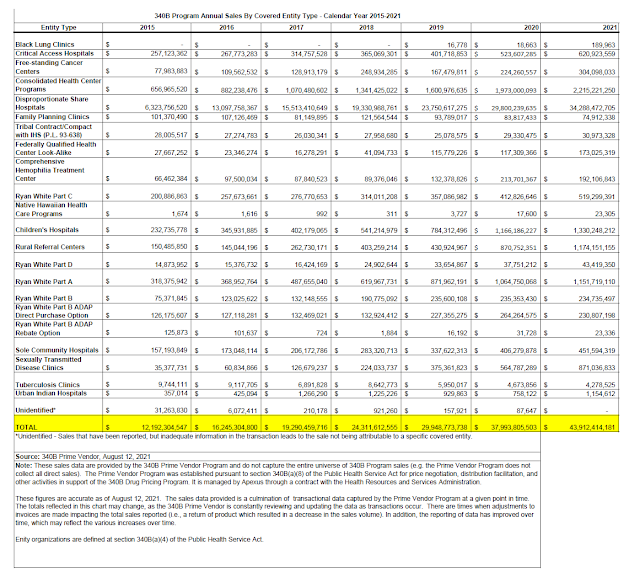

For the second year, I had to file an FOIA request to extract these data from HRSA. I have reproduced the document that I received from HRSA below.

Note that the data from Apexus include only indirect sales made via wholesalers. The $43.9 billion figure may be less than the actual total of 340B purchases at discounted prices. That’s because the Apexus data exclude an unknown amount of manufacturer sales made directly to healthcare institutions as well as some sales by specialty distributors.

Here are some other helpful references:

- For a deep dive into the pharmacy and PBM aspects of 340B, see Setcion 11.5. of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

- Exclusive: Five Pharmacy Chains and PBMs Dominate 2022’s Still-Booming 340B Contract Pharmacy Market.(Our most recent analysis of this controversial element of the program.)

EASY MONEY

The chart below documents the 340B program's astounding growth.

[Click to Enlarge]

Observations:

- Discounted purchases made under the program totaled at least $43.9 billion in 2021—an increase of 15.6% over the $38.0 billion for 2020.

- The compound average growth rate (CAGR) of 340B purchases was 23.8% from 2015 through 2021. Over the same period, manufacturers’ net brand-name drug sales (excluding COVID-19 vaccines) grew at an average annual rate of less than 4%.

- According to IQVIA, the wholesale acquisition cost (WAC) list price value of 340B purchases was $93.6 billion in 2021. (source) That equates to about 14% of pharmaceutical manufacturers’ total gross sales of brand-name drugs at list prices. (This figure also excludes COVID-19 vaccines.)

- In 2021, the list-to-340B gap—the difference between purchases at list prices and purchases at 340B discounted prices—grew to $49.7 billion (=$93.6 minus $43.9). That’s $7.0 billion higher than the 2020 gap.

- We estimate that the total value of pharmaceutical manufacturers’ gross-to-net reductions for brand-name drugs was $236 billion in 2021. (See Warped Incentives Update: The Gross-to-Net Bubble Exceeded $200 Billion in 2021.) Therefore, manufacturers’ discounts under the 340B Drug Pricing Program accounted for more than one-third of the total gross-to-net reductions for brand-name drugs.

For the first time, HRSA provided me with purchases by 340B covered entity type. The table below summarizes what happened in 2021.

[Click to Enlarge]

As you can see, nearly every type of covered entity purchased more products at discounted 340B prices in 2021 compared with 2020. What’s more, hospitals were the primary beneficiaries of the 340B program.

A little-known fact: Apexus is owned by Vizient, one the largest hospital group purchasing organizations. That’s right: The federal government outsources operations of a program that primarily benefits hospitals to an organization owned by hospitals.

Fox, meet henhouse.

WHAT’S NEXT?

The 340B Drug Pricing Program is now unambiguously the second-largest government pharmaceutical program, based on net drug spending. But unlike such programs as Medicare Part D and Medicaid, 340B lacks a regulatory infrastructure, well-developed administrative controls, and clear legislation to guide the program.

Congress has just passed the Inflation Reduction Act, which will sharply reduce pharmaceutical manufacturers’ revenues. It’s long past time for legislators to revisit the out-of-control and unregulated 340B program.

In the meantime, the programs’ defenders may want to cool their rhetoric. A while back, lobbying group 340B Health faulted me for exaggerating the size and growth of the 340B program, because “Allegations of ‘explosive 340B growth’ are not supported by the numbers.” Really? More recently, the group launched a website that states: ”Drug companies are cutting hospitals’ access to 340B savings…”

Hmm. 340B Health is entitled to their own opinion, but not their own facts. They will be working extra hard to spin the latest HRSA numbers.

FOIA FOR U

Here is the actual document that I received from HRSA:

[Click to Download]

Enjoy!

P.S. Two oddities about the document above:

- The figures shown for 2015 sum to $8,892,304,847, not the $12,192,305,547 figure shown in the Total row of the table. However, previous disclosures from HRSA indicate that $12,192,305,547 is the correct figure.

- The source is shown to be "340B Prime Vendor, August 12, 2021." However, the date should read 2022.

No comments:

Post a Comment