Today, I examine the seven largest retail chains’ 2023 participation in the 22 major 2023 Part D preferred networks that the eight largest plan sponsors will offer. As always, I offer you a handy table for scoring each chain’s participation and changes from 2022 to 2023.

As you’ll see, Kroger’s decision to exit Express Scripts commercial pharmacy networks has had negative ramifications for its Part D position. Kroger will be out-of-network—not just non-preferred—in the major Part D networks for which Express Scripts acts as the PBM. That will be a key factor behind its $1+ billion revenue hit.

Speaking of 2023, please join me for my upcoming live video webinar, Drug Channels Outlook 2023, on December 16, 2022, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

PREFER ME

Preferred network models have grown rapidly within the Medicare Part D program. The Centers for Medicare & Medicaid Services (CMS) calls them preferred cost sharing networks. CMS calls the pharmacies in such networks preferred cost sharing pharmacies.

For 2023, nearly all of the total 804 Medicare Part D regional prescription drug plans (PDP) have a preferred network. See our previous article for more details on next year’s market.

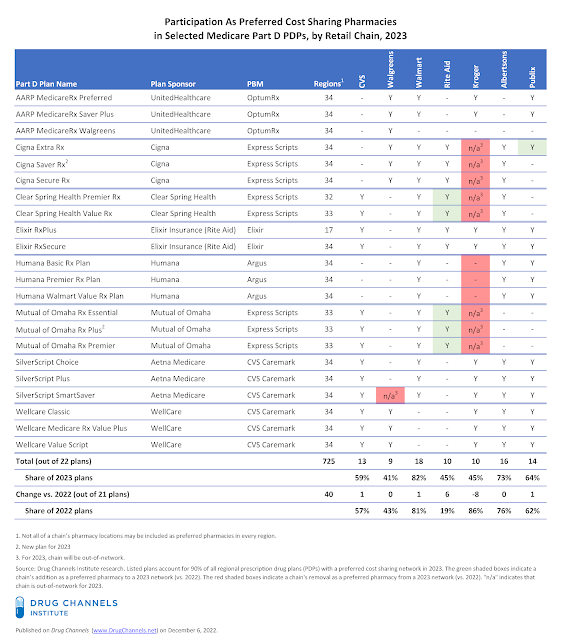

We have examined the 22 Part D plans offered by eight major companies. There will be 21 major multi-regional Part D plans with preferred cost sharing pharmacy networks and 1 smaller plan (Elixir RxPlus). These companies will operate 725 regional PDPs, which equates to 90% of total regional PDPs. For each plan, we have identified the network status of seven large retail chains.

You can find our analysis of retail chain participation in 2022 plans here: CVS, Walgreens, Walmart, and Supermarkets Keep Position in 2022 Part D Preferred Networks—With a Little Help from 340B. For more on the economics and strategies of narrow networks, see Chapter 7 of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

CHAIN REACTION

With the exception of Kroger and Rite Aid, the major chains will be in a comparable share of the total available networks in 2023 compared with 2022.

The table below summarizes retail chain participation as preferred pharmacies. The green shaded boxes indicate a chain’s addition as a preferred pharmacy to a 2023 network (vs. 2022). The red shaded boxes indicate a chain's removal as a preferred pharmacy from a 2023 network (vs. 2022). "n/a" indicates that chain is out-of-network for 2023. Click here to download the table as a PDF.

[Click to Enlarge]

Here are the highlights of pharmacy participation in 2023 Part D preferred networks:

- CVS Health. Since the 2018 plan year, CVS Health’s retail pharmacies have actively pursued preferred status in Part D plans. For 2023, CVS pharmacies will be preferred in 13 of the 22 plans tracked in the table above. CVS’s participation is comparable to that of 2022.

- Walgreens Boots Alliance. Since 2021, Walgreens has focused on participation in preferred networks. For 2023, it will be preferred in nine plans. However, for 2023, Walgreens will be an out-of-network pharmacy for Aetna’s SilverScript SmartSaver.

- Walmart. Beginning in 2020, Walmart reengaged with preferred cost sharing networks. For 2023, it will again have a leading position as a preferred pharmacy in 18 of the 22 major plans. It did not lose preferred status in any plans, and gained position in the new Mutual of Omaha Rx Plus plan.

Medicare history buffs should note that Walmart and Humana launched the first Part D preferred network plan, in 2010. This plan is now known as the Humana Walmart Value Rx Plan. Despite the plan’s name, Albertsons and Publix will again be preferred in it for 2023.

- Kroger. For 2023, Kroger— the sixth-largest U.S. pharmacy (for now)—will have a major reversal of fortune. For 2022, Kroger is preferred in 18 of the 21 plans, exceeding all other major chains. But for 2023, it will be preferred in only 10 plans—and out-of-network at eight of the 22 top plans.

The company has publicly announced “its intention to terminate their pharmacy provider agreement for commercial customers” of Express Scripts. Last week, Kroger disclosed that that its exit from Express Scripts' pharmacy networks will reduce its annual revenues by about $1.2 billion, or 8% of its total retail and specialty prescription revenues. The chain's PBM negotiations also led to a major disruption for GoodRx’s discount card business. (See The GoodRx-Kroger Blowup: Spread Pricing, Pharmacy Margins, and the Future of Discount Cards.)

Its proposed merger with Albertsons will give it much more heft in pharmacy negotiations, although the combined companies would still only be the sixth-largest U.S. pharmacy. Let's see how a bigger supermarket player will use its prospective leverage in PBM negotiations

- Rite Aid. The industry’s smallest large chain boosted its participation in the major networks, despite its limited geographic scope. For 2023, Rite Aid will participate as a preferred pharmacy in eight plans that are sponsored by external companies, as well as the two plans sponsored by Elixir, its in-house PBM. As you can see above, Rite Aid added five plans that exclude Kroger from their networks.

- Other supermarket chains. Albertsons and Publix retained their participation in the preferred networks for the fifth consecutive year. Albertsons pharmacies will again be preferred in 16 plans, while Publix will be preferred in 14 plans.

Tomorrow, I’ll delve into how smaller pharmacies will participate in the 2023 Part D plans, by examining the pharmacy services administrative organizations (PSAOs).

No comments:

Post a Comment