For 2023:

- 98% of stand-alone Medicare Part D prescription drug plans (PDP) will have a preferred network.

- 52% of Medicare Advantage prescription drug (MA-PD) plans will have a preferred network.

The largest companies made only minor changes to their 2023 stand-alone plans, after streamlining their 2022 plans. I also update our analysis of the prevalence of preferred networks in three different types of MA-PD plans.

In upcoming articles, I’ll investigate what we can deduce from chain and independent pharmacies’ participation in the major 2023 preferred networks.

LOOKING FOR CLUES

A preferred network gives consumers a choice of pharmacy while providing financial incentives to use the pharmacies that offer the payer lower costs or greater control. A consumer with a preferred network benefit design retains the option of using any pharmacy in the network. However, the consumer’s out-of-pocket expenses will be higher at a non-preferred pharmacy.

Preferred network models have grown rapidly within the Medicare Part D program, where CMS calls them preferred cost sharing networks. CMS calls the pharmacies in such a network preferred cost sharing pharmacies.

According to federal regulations, preferred pharmacies in Part D must offer “covered Part D drugs at negotiated prices to Part D enrollees at lower levels of cost sharing than apply at a non-preferred pharmacy under its pharmacy network contract.” (source) Beneficiaries who qualify for the Low-Income Subsidy (LIS) face low out-of-pocket drug costs regardless of a pharmacy’s preferred status.

To identify the 2023 Part D preferred cost sharing pharmacy networks, we used the 2023 Plan Finder Data (October 24, 2022) and the 2023 Landscape Source Files (v 10 14 22) for PDPs and MA plans.

Our analysis of stand-alone PDPs eliminated the following plans from the sample:

- Employer-sponsored plans

- Plans from U.S. territories and possessions (American Samoa, Guam, Northern Mariana Islands, Puerto Rico, Virgin Islands)

- Employer/union-only group plans (contracts with "800 series" plan IDs)

DETECTING A TREND

Our final PDP sample included 72 PDPs, which will operate 804 regional PDPs:

- Sixteen plans are being offered in all 34 regions, for a total of 544 PDPs (=16*34).

- Four plans are operating in 33 regions, one plan is operating in 32 regions, and one plan is operating in 17 regions. These six plans account for a further 181 regional PDPs.

- The remaining 50 plans are operating in eight or fewer regions and account for 79 PDPs. Many of these plans are state-level Blue Cross Blue Shield plans.

- Health maintenance organizations (HMOs): 2,337 local plans

- Preferred provider organizations (PPOs): 1,572 local plans and 41 regional plans

- Private fee-for-service (PFFS) plans: 29 plans

THE USUAL SUSPECTS

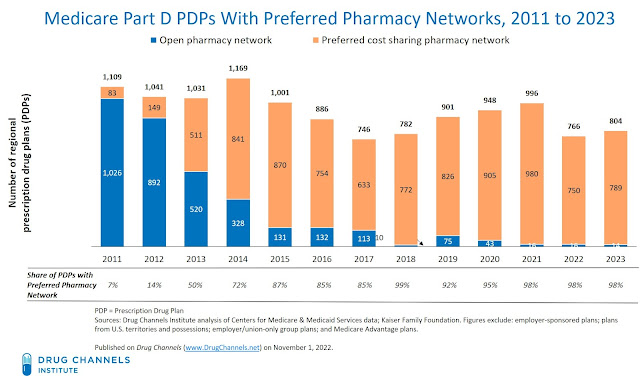

The chart below shows the growth of preferred networks in stand-alone prescription drug plans. In 2011, only 7% of total regional PDPs had a preferred network. For 2023, 98% of Medicare Part D regional prescription drug plans (PDP) will have a preferred network. That penetration is comparable to the past few years.

[Click to Enlarge]

From 2015 to 2017, the share of plans with a preferred network remained fairly steady. During this period, however, the total number of plans declined significantly, from 1,169 in 2014 to 746 in 2017. From 2017 to 2021, the total number of plans increased by 34%, to 996. The number of plans with preferred networks, meanwhile, increased by 55%, from 633 in 2017 to 980 in 2021.

For 2022, the number of stand-alone PDPs dropped by -23%, from 966 to 766 plans. As we discussed in last year’s analysis, this drop reflected consolidation among plan sponsors. For 2023, the number of plans rebounded, to 804 plans. The increase was due almost entirely to the Mutual of Omaha’s introduction of a third plan option (discussed below).

MA-PDs are much less likely to offer plans with preferred pharmacy networks. Overall, only 52% of these plans will have preferred networks. The prevalence of preferred pharmacy networks will vary by plan type:

[Click to Enlarge]

Notably, the share of preferred provider organizations MA-PD plans with preferred plans dropped, from 75% of plans in 2022 to 55% of plans in 2023. I speculate that plans are trying to make Medicare Advantage more attractive to seniors by giving them more flexible pharmacy choices.

Part D enrollment in MA-PD plans has increased over time, while enrollment in stand-alone PDPs has decreased in recent years. (source) I suspect more open networks are contributing to this trend.

COUNT ON THEM

Here are the 2023 highlights from the eight major companies with national stand-alone PDPs. These companies account for 725 (90%) of the total 804 PDPs. None of these companies’ plans will have an open retail network. All of the plans have preferred cost sharing networks.

- Aetna Medicare will offer the two legacy CVS Health SilverScript Choice and Plus plans, as well as the SilverScript SmartRx plan that was launched in 2021. Recall that CVS Health’s Part D business is now integrated with Aetna and reported within the company’s Health Care Benefits segment.

- Cigna will offer three plans: Extra, Saver, and Secure. The Saver plan is new for 2023 and includes low premiums, low copays, and an emphasis on generic drug savings. Note that Express Scripts no longer offers its own plans separately from Cigna.

- Clear Spring Health entered the market in 2020 and will offer two plans with preferred networks: Clear Spring Health Premier Rx and Clear Spring Health Value Rx. Clear Spring Health is part of the Group One Thousand One insurance company.

- Humana will offer the three plans that it has offered since 2020—Basic Rx, Premier Rx Plan, and the Humana Walmart Value Rx Plan. The Humana Basic Rx plan switched from an open network to a preferred retail network for 2021.

- Mutual of Omaha Rx will offer its Rx Essential (new for 2023), Rx Plus, and Rx Premier plans. Mutual of Omaha launched its plans for the 2019 plan year and are offered through Omaha Health Insurance Company, a Mutual of Omaha affiliate company.

- Rite Aid’s Elixir will offer its RxSecure PDP in all 34 regions, but its Elixir RxPlus plan in only 17 regions. The Elixir business was previously known as EnvisionRx.

- UnitedHealthcare will offer the same plans as it did foe 2022: two AARP-branded plans and a co-branded AARP MedicareRx Walgreens plan.

- WellCare, which is now part of Centene, will offer three plans in 2022: Wellcare Classic; Wellcare Value Script; and Wellcare Medicare Rx Value Plus. All three plans have been available since 2020. Last year, WellCare stopped offering the three plans—Rx Saver, Rx Select, and Rx Value Plus—that it had acquired as part of the Aetna-CVS Health merger.

No comments:

Post a Comment