- CVS disassociates itself from its chain pharmacy association

- Payers are paying attention to ICER

- Benefits of the biosimilar boom

- A fantastic takedown of health insurance deductibles

P.S. Join my nearly 30,000 (!) LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter, where I have more than 14,700 followers.

CVS Leaves NACDS, POLITICOJoin me next week for my new live video webinar, Specialty Drugs Update: Trends, Controversies, and Outlook, on July 29, 2022, from 12:00 p.m. to 1:30 p.m. ET. I’ll cover market trends, payer strategies, channel developments, key trends that will help you plan for the future, and more. Click here for details and registration info.

Whoa. CVS Health is dropping out of the National Association of Chain Drug Stores (NACDS). CVS was one-quarter of the association’s total store membership and paid annual dues of $1.6 million.

The retail pharmacy market is bad and going to get worse. My $0.02: With Larry Merlo long gone, CVS is fully embracing its identity as a PBM, insurer, and provider.

The (not quite) Total Store Expo in August will be sobering. Meanwhile, read this Drug Store News story for CVS Health’s bland statement on this move.

The retail pharmacy market is bad and going to get worse. My $0.02: With Larry Merlo long gone, CVS is fully embracing its identity as a PBM, insurer, and provider.

The (not quite) Total Store Expo in August will be sobering. Meanwhile, read this Drug Store News story for CVS Health’s bland statement on this move.

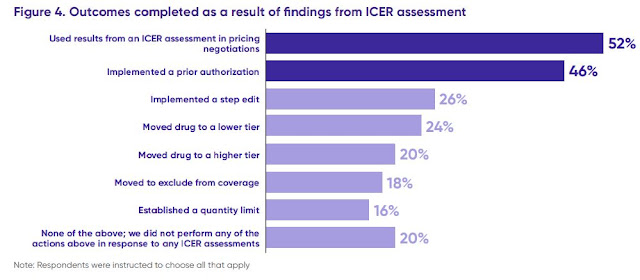

The current impact of ICER assessments on payer decision making, Xcenda

Like it or not, payers are using Institute for Clinical and Economic Review (ICER) assessments to alter price negotiations, prior authorization, and benefit design. Check out the sobering findings below, which were based on a survey of advisors from health plans, IDNs, and PBMs.

[Click to Enlarge]

2022 Trends In Biosimilars Report: Preview, Amgen

I highly recommend this excellent—and free—preview of Amgen’s forthcoming 2022 Trends In Biosimilars Report. Drug Channels salutes Amgen for again sponsoring this valuable resource.

As I predicted two years ago, the biosimilar boom is finally here. Prices are dropping while adoption accelerates. Prices are now declining by 9% to 22% annually. For therapeutic areas with biosimilars launched in the last three years, biosimilars’ market share averages 74%.

Consider these data from the report’s pages 8 and 9:

As I predicted two years ago, the biosimilar boom is finally here. Prices are dropping while adoption accelerates. Prices are now declining by 9% to 22% annually. For therapeutic areas with biosimilars launched in the last three years, biosimilars’ market share averages 74%.

Consider these data from the report’s pages 8 and 9:

[Click to Enlarge]

Before the boom began, Dr. Scott Gottlieb, a former FDA commissioner, argued that we shouldn’t give up on biosimilars and prematurely regulate prices. As we can now see, Dr. Gottlieb was right. #NoTowelWhat’s Wrong With Health Insurance? Deductibles Are Ridiculous, for Starters., The New York Times

Please enjoy Aaron Carroll’s well-written and entertaining takedown of health insurance deductibles.

Here’s a choice excerpt:

Here’s a choice excerpt:

“Deductibles are, frankly, ridiculous. The use of deductibles assumes that all medical spending is the same and that the system should disincentivize all of it, starting over each Jan. 1. There is no valid argument for why that should be.”‘nuff said.

Meet the Newest Members of our Advisory Board, Alto Pharmacy

I am pleased to announce that I will be joining the advisory board of Alto Pharmacy, one of the most promising new venture-backed companies in the pharmacy space.

Here is my comment from the Alto announcement above:

ICYMI, Alto is one of the companies highlighted in Section 12.4.2. of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Here is my comment from the Alto announcement above:

“The pharmacy industry has entered a period of structural change. There’s a tremendous need for the cost transparency, efficiency, and commitment to patient well-being that Alto delivers. I’m thrilled to support Alto in building innovative solutions to foundational issues within the industry.”Please reach out if you have questions or want more info about Alto.

ICYMI, Alto is one of the companies highlighted in Section 12.4.2. of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

No comments:

Post a Comment