- Eli Lilly discloses the bonkers gross-to-net economics for Humalog insulin

- John O’Brien of HHS blasts the current drug pricing system

- The Community Access National Network’s 340B Commission releases an excellent new report—and you can read my testimony, too!

P.S. Join the more than 7,200 people who follow my comments and links at @DrugChannels on Twitter.

SAVE THE DATE: Drug Channels Institute will hold a special live, interactive webinar titled Preparing for a World Without Rebates on April 12, 2019, at 12 PM ET. Details and registration information will be announced on Monday.

ELI Lilly and Company: 2018 Integrated Summary Report, Eli Lilly and Company

Eli Lilly has released its annual transparency report. For 2018, the average list prices of its products grew by 5.5%, while net prices (after rebates and discounts) declined by 0.5%.

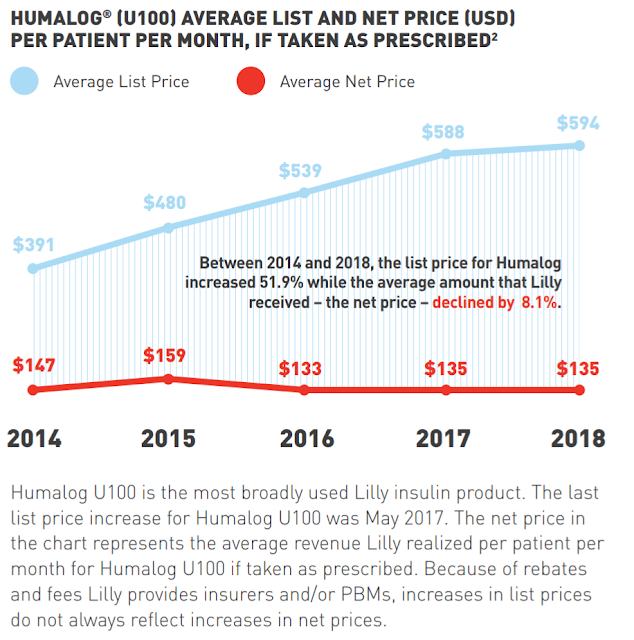

Page 65 of the report reveals detailed data about Humalog (U100), its top-selling insulin product. As far as I know, this is the industry’s most detailed pricing disclosure regarding a single product.

Over the past five years, the per-patient list price of Humalog insulin rose by 52%, while the net price declined by 8%. What’s more, the average annual value of Lilly’s per-patient rebates and discounts grew, from $2,928 in 2014 to $5,508 in 2018.

Humalog perfectly illustrates the gross-to-net bubble. Too many patients pay full price for essential drugs that are sold to insurers and PBMs at deep discounts. The prescription economics of insulin mirror the example in How Health Plans Profit—and Patients Lose—From Highly-Rebated Brand-Name Drugs..

For more on gross-to-net pricing, see Section 9.1. of our new 2019 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Page 65 of the report reveals detailed data about Humalog (U100), its top-selling insulin product. As far as I know, this is the industry’s most detailed pricing disclosure regarding a single product.

Over the past five years, the per-patient list price of Humalog insulin rose by 52%, while the net price declined by 8%. What’s more, the average annual value of Lilly’s per-patient rebates and discounts grew, from $2,928 in 2014 to $5,508 in 2018.

[Click to Enlarge]

Humalog perfectly illustrates the gross-to-net bubble. Too many patients pay full price for essential drugs that are sold to insurers and PBMs at deep discounts. The prescription economics of insulin mirror the example in How Health Plans Profit—and Patients Lose—From Highly-Rebated Brand-Name Drugs..

For more on gross-to-net pricing, see Section 9.1. of our new 2019 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Patients need transparency and relief from high drug costs, not defense of the status quo, U.S. Department of Health & Human Services

John O'Brien, senior advisor to the secretary for drug pricing reform at the U.S. Department of Health & Human Services, defends the Medicare Part D rebate reform proposal in this blistering op-ed. Lead sentence: "The current drug pricing system is broken and indefensible." Whoa.

Here’s another good one:

Here’s another good one:

“Further, projections of premium increases operate from the unrealistic assumption that Part D plans won’t do what everyone who knows the market expects them to do, which is find a way to hold down premiums, through increased use of generics, tougher negotiation, or reduced overhead.“I offer my speculations about likely PBM and plan behaviors in A World Without Rebates: Predictions for How the Channel Will Evolve and Why Drug Prices Will Go Down.

340B DRUG DISCOUNT PROGRAM: The Issues Spurring Discussion, Stakeholder Stances and Possible Resolutions, The Community Access National Network (CANN)

Anyone interested in the 340B Drug Pricing Program should check out this report. It offers a comprehensive overview of the program and provides many policy suggestions.

Kudos to CANN for having posted all of the background materials and testimony here.

Click here to read my testimony about contract pharmacies—market observations, channel distortions, and policy recommendations.

Kudos to CANN for having posted all of the background materials and testimony here.

Click here to read my testimony about contract pharmacies—market observations, channel distortions, and policy recommendations.

The Inventor: Out for Blood in Silicon Valley, HBO

In How Walgreens Got Taken: Read This Fantastic New Book About Theranos, I reviewed John Carreyrou’s Bad Blood: Secrets and Lies in a Silicon Valley Startup.

HBO has just released an excellent documentary on Elizabeth Holmes, the founder of Theranos. It’s a fascinating look at Silicon Valley hype and Ms. Holmes brazen misrepresentations. Definitely worth watching. I was struck by the startling disconnect between Holmes’ public statements and the behind-the scenes business realities.

Walgreens makes a brief but ignominious appearance about half way through the documentary. Its in-store marketing materials and commercials are pretty awkward in light of what happened to patients.

Watch the trailer below. Click here if you can’t see the video.

HBO has just released an excellent documentary on Elizabeth Holmes, the founder of Theranos. It’s a fascinating look at Silicon Valley hype and Ms. Holmes brazen misrepresentations. Definitely worth watching. I was struck by the startling disconnect between Holmes’ public statements and the behind-the scenes business realities.

Walgreens makes a brief but ignominious appearance about half way through the documentary. Its in-store marketing materials and commercials are pretty awkward in light of what happened to patients.

Watch the trailer below. Click here if you can’t see the video.

No comments:

Post a Comment